Are you struggling to manage your money?

Many people find it hard to keep track of where their money goes.

You need a clear way to see your income and expenses.

This article will help you understand two popular tools: Zoho Books vs Quicken.

Let’s find out which one wins the battle for your financial peace of mind!

Tinjau

We looked closely at both Zoho Books and Quicken.

We tested their features.

This helped us see how they work.

Now, we can compare them fairly for you.

With its free plan for businesses earning under $50,000 annually, Zoho Books is an excellent and accessible entry point.

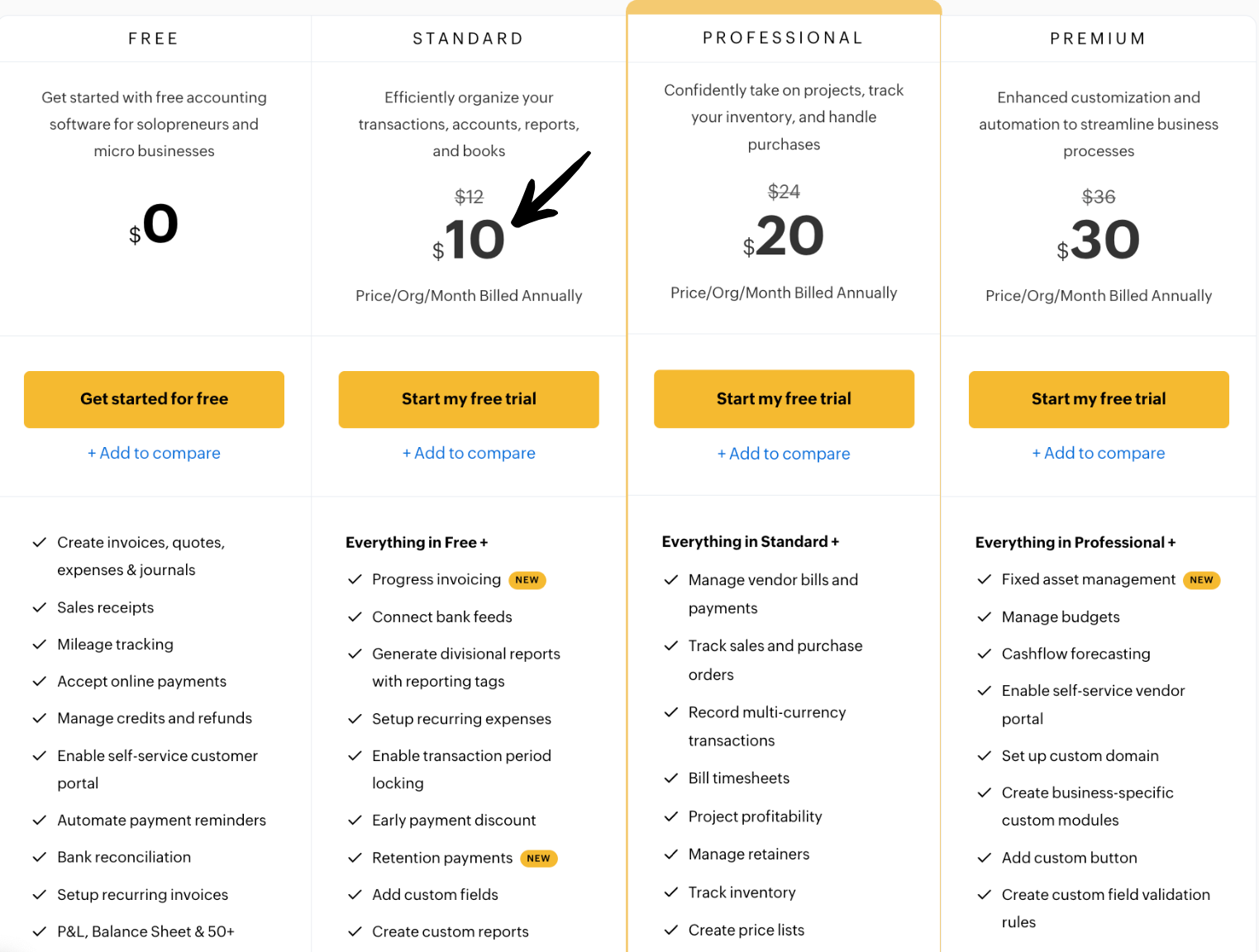

Harga: It has a free trial. The premium plan starts at $10/month.

Fitur Kunci:

- Client Portal

- Project Billing

- Inventory Management

Ingin mengendalikan keuangan Anda? Dengan Quicken, Anda dapat terhubung dengan ribuan lembaga keuangan. Jelajahi selengkapnya!

Harga: Tersedia uji coba gratis. Paket premiumnya seharga $5,59/bulan.

Fitur Kunci:

- Alat Penganggaran

- Manajemen Tagihan

- Pelacakan Investasi

What is Zoho Books?

So, you’re curious about Zoho Books?

It’s like a helpful tool for your business money stuff.

It helps you keep track of your income and expenses.

Think of it as your digital bookkeeper!

Juga, mengeksplorasi favorit kita Zoho Books alternatives…

Manfaat Kunci

- Offers a free plan for businesses with revenue under $50,000.

- Integrates with over 40 Zoho applications.

- Provides more than 50 pre-built financial reports.

- Has a client portal that boosts payment collection by 30%.

- No # warranty.

Harga

- Bebas: $0/bulan.

- Standar: $10/bulan.

- Professional: $20/month.

- Premi: $30/month.

Pro

Kons

Apa itu Quicken?

Jadi, Anda ingin tahu tentang Quicken?

Ini seperti alat yang membantu Anda melihat semua hal terkait keuangan Anda di satu tempat.

Anggap saja ini sebagai pengelola keuangan digital Anda.

Aplikasi ini dapat membantu Anda melacak rekening bank, tagihan, dan bahkan investasi Anda.

Pretty handy.

Juga, mengeksplorasi favorit kita Alternatif Quicken…

Manfaat Kunci

Quicken adalah alat yang ampuh untuk mengatur kehidupan keuangan Anda.

Mereka membanggakan pengalaman lebih dari 40 tahun dan telah menjadi produk terlaris nomor 1.

Berbagai paket layanan mereka dapat terhubung dengan lebih dari 14.500 lembaga keuangan.

Anda juga bisa mendapatkan garansi uang kembali 30 hari untuk mencobanya tanpa risiko.

- Terhubung dengan ribuan bank dan kartu kredit.

- Membuat anggaran terperinci.

- Melacak investasi dan kekayaan bersih.

- Menawarkan perangkat bantu perencanaan pensiun.

Harga

- Quicken Simplifi: $2,99/bulan.

Pro

Kons

Perbandingan Fitur

Making the right choice between akuntansi software options is crucial for business owners.

This feature comparison of Zoho Books vs Quicken will help you evaluate which akuntansi program offers the right features to manage your financial health and business finances effectively.

1. Core Accounting Functionality

- Buku Zoho is a comprehensive online accounting program designed specifically for small businesses. It provides a full suite of core features including creating and sending professional invoices, tracking expenses, managing accounts receivable, and generating detailed financial reports. It also includes a client portal and a vendor portal for seamless collaboration tools.

- Mempercepat, historically a personal finance software, has a version called Quicken Home & Business that provides some business accounting functionality. The main functionality is for tracking and categorizing business and personal financial transactions in one place. Its core features are centered around budgeting, bill tracking, and monitoring investment accounts, with a lesser focus on full-fledged business operations.

2. Penagihan dan Pembayaran

- Buku Zoho excels at invoicing. You can create invoices, set up recurring invoices, and send automated invoice reminders. It integrates with various payment gateways and supports Zoho Payments to facilitate online payments, helping you get paid faster.

- Mempercepat has a more basic invoicing functionality within its Quicken Home & Business platform. It allows users to send invoices to bill clients, but it does not have the same level of advanced features for otomasi or the wide variety of online payments options as Zoho Books.

3. Automation Features

- Buku Zoho offers robust automation features to reduce manual data entry and repetitive tasks. It provides automatic bank feeds, transaction matching, automated revenue recognition, and custom workflows. These automation tools help to streamline accounting tasks and save a significant amount of time.

- Itu Mempercepat brand also offers some automation functionality. It automatically downloads and categorizes transactions from connected bank and investment accounts. This functionality is a key feature for those looking to simplify their financial analysis and get a full financial picture without manual intervention.

4. Expense and Expense Tracking

- Buku Zoho provides a powerful expense tracking feature. Users can log expenses by uploading receipts, which are then auto-scanned to create transactions. The platform helps business owners to manage vendor invoices and recurring expenses efficiently.

- Mempercepat offers detailed expense tracking for both business and personal expenses. The Quicken software allows users to categorize spending for their business and personal accounts, making it a good choice for those who need to separate their business and personal finances. It is also well-suited for tracking rental properties.

5. Harga dan Paket

- Buku Zoho has a variety of pricing plans, including a free plan for businesses with a lower annual revenue. This free version and a free trial allow usaha kecil owners to evaluate the software. The paid plans (Standard, Professional, Premium, and Elite) offer extensive customization and competitive pricing.

- Mempercepat is primarily sold as a subscription. The Quicken Deluxe and Quicken Premier versions are for personal finance and investing, while Quicken Home & Business is the go-to for business owners. The pricing is an affordable pricing model for personal use, but the business-related subscription is a separate download and purchase.

6. Integrations

- Buku Zoho seamlessly integrates with other products in the Zoho ecosystem, such as Zoho CRM and Zoho Inventory. This allows for a connected business platform. It also supports third party integrations with other business applications and software vendors.

- Mempercepat has a more limited focus on third-party integrations compared to Zoho Books. Its functionality is mostly self-contained, but it can connect to thousands of financial institutions for automatic bank reconciliation and account balance monitoring.

7. Reporting

- Buku Zoho provides advanced analytics and a wide range of financial reports to give business owners a clear view of their financial health. You can analyze & generate detailed reports on everything from sales to expenses and tax compliance.

- Mempercepat offers strong pelaporan functionality, particularly for personal finance and investment accounts. The Quicken review from many users often highlights its ability to generate detailed reports on spending, budgets, and investment performance, which is a core part of its functionality.

8. Accessibility and Platform

- Buku Zoho is a cloud-based platform accessible through a web browser and dedicated mobile app for iOS & Android. This allows multiple users to access & work on accounting tasks from anywhere with an stable internet connection.

- Mempercepat is available as a desktop program for Windows and Mac. While it does offer a mobile app, it is a companion to the main desktop software. The primary Quicken software is downloaded and installed on your computer, giving you more direct control over the program.

9. Inventory Management and Tracking

- Buku Zoho offers robust inventory management and inventory tracking features in its paid plans. This is a key feature for businesses that sell products and need to manage stock levels, purchase orders, and monitor their inventory effectively.

- Mempercepat does not have built-in inventory management. Its focus is on financial transactions and balances, not the physical tracking of goods. This is a significant distinction that separates the two as a complete business solution versus a financial planning tool. For decades, Quicken has been a dominant force in personal finance, and its Quicken Business version allows users to manage their business personal finances together in one place.

Apa yang perlu diperhatikan dalam sebuah perangkat lunak akuntansi?

- Features and Functionality: You need to identify what features are essential for your business’s day-to-day operations. This includes core accounting tasks like expense tracking, managing accounts payable & receivable, & generating financial reports. For many small businesses, features like the ability to create invoices and handle online payments are crucial. Look for advanced features and automation tools that can help you streamline repetitive tasks and save time. Some software offers inventory management, payroll services, or pelacakan waktu, which may be necessary depending on your business model.

- Kemudahan Penggunaan: The basic user interface should be intuitive & easy to use. An accounting program that’s difficult to learn can lead to errors and frustration, even if it has a lot of features. Look for a clean design and straightforward navigation. Many platforms offer a free trial or a free version, which is a great way to test the user interface before committing to a paid plan. A good program should also offer helpful resources like an extensive FAQ section or customer support to assist you.

- Cost and Scalability: Consider the pricing plans and whether the software offers affordable pricing that fits your budget. Many vendors have different tiers, from a standard plan to a premium plan or professional plan, with competitive pricing and extensive customization. This scalability is important, as it ensures the software can grow with your business. You want a solution that can handle your needs now and in the future, allowing for more users or additional features as your business expands its annual revenue.

- Security and Accessibility: Your financial data is sensitive, so data security is paramount. Look for software vendors that offer robust security measures, such as data encryption & regular backups. Also, consider accessibility. A mobile app and cloud-based access allow you to manage your accounts from anywhere, which is a great benefit for modern business owners.

- Integrations and Support: Membuat sure the software integrates with other platforms you use, like a bank or a payment gateway. This can save you from a lot of manual data entry. Finally, evaluate the customer support offered. A responsive & knowledgeable support team is invaluable when you encounter issues.

- While this may be suitable for a small business at the beginning of its journey, many companies eventually transition to a more dedicated business solution like QuickBooks. A recent development in the market is the acquisition of Quicken by Aquiline Capital Partners, which may dampak the product’s future direction and functionality, so see how it might protect the future of your financial data and retirement planning.

Keputusan Akhir

So, which one should you pick?

If you run a usaha kecil and need strong tools for invoicing, tracking business expenses.

Zoho Books is our top choice. It’s built for businesses and makes managing your finances simpler.

However, if you’re looking for help with your money, like budgeting, tracking investments, and general household spending.

Then Quicken is the clear winner.

It’s designed to help individuals and families get a grip on their finances.

So you can trust our advice to make the best decision for your money needs.

More of Zoho Books

When choosing an accounting solution, it’s wise to compare the top options.

We’ve done the research to help you see how Zoho Books stacks up against its key competitors.

- Zoho Books vs QuickBooks: QuickBooks is a market leader, known for its extensive features and integrations. Zoho Books, however, is often praised for its clean interface and more affordable, scalable pricing, particularly for small to medium businesses.

- Zoho Books vs Xero: Xero is a popular cloud accounting platform with a focus on ease of use. While both offer strong core features, Zoho Books provides more robust inventory management in its higher-tier plans.

- Zoho Books vs FreshBooks: FreshBooks is a great choice for freelancers and service-based businesses, with a focus on invoicing. Zoho Books offers a more comprehensive accounting program with a wider range of features beyond just billing.

- Zoho Books vs Sage: Sage generally targets larger, more complex businesses. Zoho Books is a better fit for small to medium-sized businesses and is known for its user-friendly interface and competitive pricing.

- Zoho Books vs NetSuite: NetSuite is a powerful ERP solution for large enterprises. Zoho Books is an excellent alternative for small businesses that need a robust, affordable, and flexible platform that can grow with them.

- Zoho Books vs Wave: Wave is a popular option for its free version. While Wave is great for very small businesses and freelancers, Zoho Books offers a more comprehensive feature set and is a more scalable option for growing businesses.

- Zoho Books vs Dext: Dext is primarily a data extraction tool, focused on automating receipt and invoice processing. Zoho Books, on the other hand, is a full-fledged accounting software that includes expense management as one of its many features.

- Zoho Books vs Synder: Synder specializes in syncing financial transactions from various sources to accounting software. Zoho Books includes this functionality as part of its complete platform, alongside invoicing, reporting, and other core accounting features.

- Zoho Books vs Expensify: Expensify is a strong expense reporting and management tool. Zoho Books has built-in expense management, but Expensify is a more specialized option for businesses with complex expense policies.

- Zoho Books vs Docyt: Docyt uses AI to automate data entry from receipts and bank statements. Zoho Books also has automation features, but Docyt’s core focus is on this specific automation.

- Zoho Books vs Hubdoc: Hubdoc is a document management tool that automates data extraction from bills and receipts. Zoho Books offers a similar function, but Hubdoc’s main purpose is to feed data into other systems like QuickBooks or Xero.

- Zoho Books vs AutoEntry: AutoEntry is another tool for automated data entry from documents. Zoho Books is a complete accounting program, while AutoEntry is a specialized tool that can be used to support it.

- Zoho Books vs Puzzle io: Puzzle.io is an AI-driven accounting solution for startups that offers real-time financial insights.

- Zoho Books vs Easy Month End: Easy Month End is not a direct alternative, as it is a feature within Zoho Books that simplifies the closing process.

- Zoho Books vs Quicken: Quicken is mainly for personal finance and very small businesses, while Zoho Books is a full-featured solution designed for business accounting tasks.

- Zoho Books vs RefreshMe: This is not a direct comparison; RefreshMe is a resource or feature that may be associated with Zoho Books.

Lebih lanjut tentang Quicken

- Quicken vs PuzzlePerangkat lunak ini berfokus pada perencanaan keuangan berbasis AI untuk perusahaan rintisan. Versi pasangannya ditujukan untuk keuangan pribadi.

- Quicken vs DextIni adalah alat bisnis untuk mencatat tanda terima dan faktur. Alat lainnya melacak pengeluaran pribadi.

- Quicken vs XeroIni populer secara online. perangkat lunak akuntansi untuk usaha kecil. Pesaingnya ditujukan untuk penggunaan pribadi.

- Quicken vs SynderAlat ini menyinkronkan data e-commerce dengan perangkat lunak akuntansi. Alternatifnya berfokus pada keuangan pribadi.

- Quicken vs Easy Akhir BulanIni adalah alat bisnis untuk menyederhanakan tugas akhir bulan. Pesaingnya adalah untuk mengelola keuangan pribadi.

- Quicken vs DocytYang satu menggunakan AI untuk pembukuan dan otomatisasi bisnis. Yang lainnya menggunakan AI sebagai asisten keuangan pribadi.

- Quicken vs SageIni adalah paket perangkat lunak akuntansi bisnis yang komprehensif. Pesaingnya adalah alat yang lebih mudah digunakan untuk keuangan pribadi.

- Quicken vs Zoho BooksIni adalah alat akuntansi online untuk usaha kecil. Pesaingnya ditujukan untuk penggunaan pribadi.

- Quicken vs WaveIni menyediakan perangkat lunak akuntansi gratis untuk usaha kecil. Versi lainnya dirancang untuk individu.

- Quicken vs HubdocIni khusus untuk pengambilan data dokumen untuk pembukuan. Pesaingnya adalah alat keuangan pribadi.

- Quicken vs ExpensifyIni adalah alat manajemen pengeluaran bisnis. Yang lainnya untuk pelacakan pengeluaran pribadi dan penganggaran.

- Quicken vs QuickBooksIni adalah perangkat lunak akuntansi yang terkenal untuk bisnis. Alternatifnya dirancang untuk keuangan pribadi.

- Quicken vs AutoEntryIni dirancang untuk mengotomatiskan entri data untuk akuntansi bisnis. Alternatifnya adalah alat keuangan pribadi.

- Quicken vs FreshBooksIni adalah perangkat lunak akuntansi untuk pekerja lepas dan usaha kecil. Alternatifnya adalah untuk keuangan pribadi.

- Quicken vs NetSuiteIni adalah rangkaian perangkat lunak manajemen bisnis yang andal untuk perusahaan besar. Pesaingnya adalah aplikasi keuangan pribadi yang sederhana.

Pertanyaan Yang Sering Muncul

Is Zoho Books better for personal use?

No, Zoho Books is made for businesses. It helps with invoices and business expenses. For personal budgeting and tracking your own money, Quicken is a better fit.

Can Quicken handle business accounting?

Quicken has a “Home & Business” version. It can do some basic business tasks like simple invoicing. But for full business accounting features, Zoho Books is more powerful and complete.

Which software is easier to learn?

Both are fairly easy to learn. Zoho Books is simple for business tasks. Quicken is easy for personal finance. Your choice depends on what you need to do most often.

Do I need internet to use these?

Zoho Books is cloud-based, so you need internet to use it fully. Quicken offers desktop versions that can work offline, but you’ll need internet for updates and some online features.

Are these programs expensive?

Both Zoho Books and Quicken have different plans with different costs. Some plans are monthly, and some are yearly. You can often find a plan that fits your budget and needs.