Vous vous sentez submergée par vos mensualités ? comptabilité tâches ?

Imaginez le stress de devoir se démener pour retrouver les reçus, rapprocher les comptes et respecter les délais.

Tout en essayant de gérer votre entreprise.

Cet article explore deux sujets populaires comptabilité solutions.

Nous allons comparer les fonctionnalités d'Easy Month End et de FreshBooks pour vous aider à choisir celui qui simplifiera réellement votre gestion des fins de mois. comptabilité.

Aperçu

Pour vous donner une image aussi claire que possible.

Nous avons effectué des tests approfondis Fin de mois facile et FreshBooks, en examinant leurs fonctionnalités, leur facilité d'utilisation et leur valeur globale.

En cette fin de mois, rejoignez les 1 257 utilisateurs d'Easy qui ont économisé en moyenne 3,5 heures et réduit leurs erreurs de 15 %. Commencez votre essai gratuit !

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 45 $/mois.

Caractéristiques principales :

- Rapprochement automatisé

- Flux de travail rationalisés

- Interface conviviale

Envie de simplifier votre facturation et d'être payé plus rapidement ? Plus de 30 millions de personnes utilisent FreshBooks. Découvrez-en plus !

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 2,10 $/mois.

Caractéristiques principales :

- Suivi du temps

- Facturation

- Comptabilité

Qu'est-ce qu'une fin de mois facile ?

Parlons de la fin de mois simplifiée. De quoi s'agit-il ?

C'est un outil conçu pour faciliter vos paiements mensuels. comptabilité fermer simple.

Considérez-le comme votre guide à travers ce processus souvent redouté.

Découvrez également nos favoris Alternatives faciles pour la fin du mois…

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

Qu'est-ce que FreshBooks ?

Parlons maintenant de FreshBooks. De quoi s'agit-il exactement ?

C'est un populaire logiciel de comptabilitéDe nombreux travailleurs indépendants et petites entreprises Utilisez-le.

Il facilite la facturation, le suivi des dépenses et la gestion de projets.

Découvrez également nos favoris Alternatives à FreshBooks…

Notre avis

Fatigué(e) de la comptabilité complexe ? Plus de 30 millions d’entreprises font confiance à FreshBooks pour créer des factures professionnelles. Simplifiez-vous la vie ! logiciel de comptabilité aujourd'hui!

Principaux avantages

- Création de factures professionnelles

- Rappels de paiement automatisés

- Suivi du temps

- outils de gestion de projet

- Suivi des dépenses

Tarification

- Lite : 2,10 $/mois.

- Plus: 3,80 $/mois.

- Prime: 6,50 $/mois.

- Sélectionner: Tarification personnalisée.

Avantages

Cons

Comparaison des fonctionnalités

Voici un aperçu détaillé de la façon dont Easy Month End et FreshBooks se comparent.

Nous allons explorer les fonctionnalités clés pour vous aider à comprendre quelle plateforme vous convient le mieux.

Vos besoins spécifiques d'entreprise lors de votre choix comptabilité logiciel.

1. Objectif principal

- Fin de mois facileCet outil a pour seul but d'aider une équipe financière à gérer plus efficacement le processus de clôture de fin de mois. Il s'agit d'une solution spécialisée pour des tâches spécifiques au sein d'une équipe financière.

- FreshBooksIl s'agit d'une plateforme de solutions logicielles comptables plus large pour petite entreprise Il s'adresse aux propriétaires. Il gère tout, de la facturation au suivi des dépenses en passant par les rapports de base.

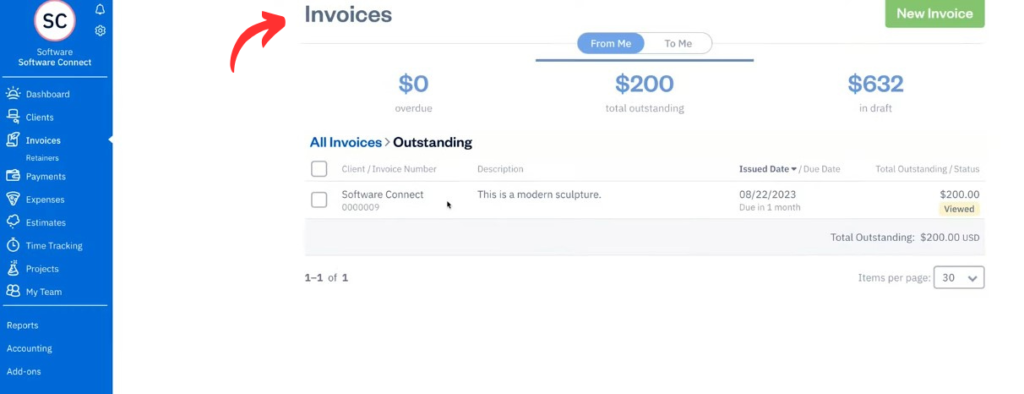

2. Facturation et paiements

- Fin de mois facileCet outil ne possède aucune fonctionnalité de facturation.

- FreshBooksFreshBooks excelle dans ce domaine. Vous pouvez créer des factures professionnelles, configurer la facturation récurrente et même accepter directement les paiements anticipés comme les cartes de crédit et les virements ACH. Il est ainsi facile d'encaisser les paiements et d'être payé plus rapidement.

3. Clôture et rapprochement de fin de mois

- Fin de mois facileC’est là son principal atout. Il offre un flux de travail structuré pour gérer toutes vos réconciliations. Il vous aide à collecter audit Elle permet de recueillir des preuves et de rationaliser le processus, ce qui conduit à une clôture de fin de mois plus fluide et à moins d'erreurs et de retards.

- FreshBooksIl gère les rapprochements bancaires de base, mais il n'est pas conçu comme un outil dédié aux rapprochements de bilan formels ou à la fourniture de documentation aux auditeurs.

4. Collaboration d'équipe et flux de travail

- Fin de mois facileIl est conçu pour la gestion d'équipe. Vous pouvez attribuer des tâches à l'équipe financière, suivre les validations et laisser des commentaires sur un ticket afin de garantir la bonne exécution des tâches.

- FreshBooksLa plateforme permet à plusieurs utilisateurs de collaborer sur des projets. Cependant, ses fonctionnalités de flux de travail ne sont pas aussi poussées ni aussi spécifiques aux processus de clôture que celles d'Easy Month End.

5. Rapports et comptabilité

- Fin de mois facile: Reporting is limited to the closing process itself. It’s not a full logiciel de comptabilité.

- FreshBooksIl fournit des rapports comptables standard comme le compte de résultat. Les formules supérieures proposent la comptabilité en partie double et facilitent le suivi de la rentabilité des projets.

6. Tarification et forfaits

- Fin de mois facile: Propose trois formules tarifaires principales qui s'adaptent à la taille de votre équipe.

- FreshBooks: Propose quatre formules, dont une formule Lite et une formule Plus, qui s'adaptent au nombre de clients facturables et aux fonctionnalités dont vous avez besoin. Le prix est généralement mensuel.

7. Facilité d'utilisation et plateforme

- Fin de mois facileLa plateforme est simple d'utilisation, mais conçue pour les professionnels de la comptabilité qui maîtrisent le processus de clôture. C'est une plateforme unique dédiée à cet usage spécifique.

- FreshBooksReconnu pour son tableau de bord FreshBooks convivial, il est considéré comme l'un des meilleurs logiciels de comptabilité pour les professionnels indépendants. petite entreprise Les propriétaires l'apprécient pour sa conception intuitive.

8. Données et intégrations

- Fin de mois facile: S'intègre à d'autres logiciels de comptabilité comme QuickBooks et Xero pour importer les données à des fins de rapprochement.

- FreshBooks: S'intègre à plus de 100 applications. Cela en fait une plateforme idéale pour la gestion des finances, notamment pour une entreprise de services qui utilise d'autres logiciels pour gérer ses projets et ses clients.

9. Capacités mobiles

- Fin de mois facileIl s'agit d'une application web. Elle ne possède pas d'application mobile dédiée.

- FreshBooks: Possède une application mobile FreshBooks très bien notée pour iOS et Android appareilsVous pouvez gérer votre entreprise en déplacement grâce à une simple connexion internet.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Votre type d'entreprise : Êtes-vous un travailleur indépendantS’agit-il d’une solution axée sur les services ou sur les produits ? Vos besoins spécifiques détermineront la solution la plus adaptée.

- Évolutivité : Le logiciel peut-il évoluer avec votre entreprise ? Pensez à l’avenir. besoins de l'entreprise.

- Besoins d'intégration : Est-ce compatible avec vos autres outils (par exemple, les passerelles de paiement, CRM)?

- Accès mobile : Avez-vous besoin de gérer vos finances en déplacement ?

- Assistance clientèle : Quel type d'aide est disponible en cas de problème ?

- Signalement Profondeur: Avez-vous besoin de simples aperçus ou d'analyses financières détaillées ?

- Sécurité: Comment la plateforme protège-t-elle vos données sensibles ? données financières?

- Interface utilisateur : Est-ce facile à apprendre et à utiliser pour vous et les membres de votre équipe ? C’est essentiel pour les nouveaux utilisateurs.

Verdict final

Après avoir testé les deux, nous recommandons FreshBooks.

Easy Month End est certes excellent grâce à son processus de clôture mensuelle dédié.

FreshBooks est une solution plus complète pour les petites entreprises.

Sa plateforme gère tout, de l'envoi des factures à la gestion de projet et suivi du temps.

FreshBooks vous offre un meilleur rapport qualité-prix au quotidien.

Son forfait premium et ses autres formules tarifaires offrent un éventail de fonctionnalités telles que les factures récurrentes et les paiements FreshBooks, simplifiant ainsi vos finances et donnant à votre équipe financière les outils qu'elle mérite.

Pour la plupart des propriétaires de petites entreprises, simplifier leur vie et gérer leur argent sans tracas est un choix plus judicieux.

Plus de fins de mois faciles

Voici une brève comparaison d'Easy Month End avec quelques-unes des principales alternatives.

- Fin de mois facile vs Puzzle io: Alors que Puzzle.io est destiné à la comptabilité des startups, Easy Month End se concentre spécifiquement sur la simplification du processus de clôture.

- Fin de mois facile vs Dext: Dext est principalement destiné à la capture de documents et de reçus, tandis qu'Easy Month End est un outil complet de gestion de la clôture de fin de mois.

- Easy Month End vs Xero: Xero est une plateforme comptable complète pour les petites entreprises, tandis qu'Easy Month End propose une solution dédiée au processus de clôture.

- Fin de mois facile vs Synder: Synder est spécialisé dans l'intégration des données de commerce électronique, contrairement à Easy Month End qui est un outil de flux de travail pour l'ensemble de la clôture financière.

- Fin de mois facile vs Docyt: Docyt utilise l'IA pour la comptabilité et la saisie de données, tandis qu'Easy Month End automatise les étapes et les tâches de la clôture financière.

- Easy Month End vs RefreshMe: RefreshMe est une plateforme de coaching financier, différente de Easy Month End qui se concentre sur la gestion des clôtures.

- Easy Month End vs Sage: Sage est une suite logicielle de gestion d'entreprise à grande échelle, tandis qu'Easy Month End offre une solution plus spécialisée pour une fonction comptable essentielle.

- Easy Month End vs Zoho Books: Zoho Books est un logiciel de comptabilité tout-en-un, tandis qu'Easy Month End est un outil spécialement conçu pour le processus de clôture mensuelle.

- Fin de mois facile vs vague: Wave propose des services de comptabilité gratuits pour les petites entreprises, tandis qu'Easy Month End offre une solution plus avancée pour la gestion des clôtures.

- Easy Month End vs Quicken: Quicken est un outil de gestion de finances personnelles, ce qui fait d'Easy Month End un meilleur choix pour les entreprises qui doivent gérer leur clôture de fin de mois.

- Easy Month End vs Hubdoc: Hubdoc automatise la collecte de documents, mais Easy Month End est conçu pour gérer l'intégralité du flux de travail de clôture et les tâches d'équipe.

- Easy Month End vs Expensify: Expensify est un logiciel de gestion des dépenses, ce qui est une fonction différente de l'objectif principal d'Easy Month End, qui est la clôture financière.

- Easy Month End vs QuickBooks: QuickBooks est une solution comptable complète, tandis qu'Easy Month End est un outil plus spécifique pour la gestion de la clôture de fin de mois.

- Fin de mois simplifiée vs saisie automatique: AutoEntry est un outil de saisie de données, tandis qu'Easy Month End est une plateforme complète pour la gestion des tâches et des flux de travail lors de la clôture.

- Easy Month End vs FreshBooks: FreshBooks est destiné aux travailleurs indépendants et aux petites entreprises, tandis qu'Easy Month End offre une solution dédiée à la clôture de fin de mois.

- Easy Month End vs NetSuite: NetSuite est un système ERP complet, dont la portée est plus large que celle d'Easy Month End, spécialisé dans la clôture financière.

Plus de FreshBooks

- FreshBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- FreshBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- FreshBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- FreshBooks contre SnyderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- FreshBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- FreshBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- FreshBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- FreshBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- FreshBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- FreshBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- FreshBooks vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- FreshBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- FreshBooks contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- FreshBooks vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- FreshBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Quelle est la principale différence entre Easy Month End et FreshBooks ?

Easy Month End se concentre principalement sur la simplification du processus de clôture comptable mensuelle et des flux de travail de rapprochement. À l'inverse, FreshBooks offre une solution comptable cloud plus complète, performante en matière de facturation, de suivi des dépenses et de fonctions de base. comptabilité pour les travailleurs indépendants et les petites entreprises.

FreshBooks peut-il remplacer Xero ou QuickBooks ?

FreshBooks peut constituer une excellente alternative pour les entreprises qui privilégient la facturation et le suivi de projets. Cependant, pour des besoins plus complexes en matière de gestion des stocks, de paie ou de comptabilité avancée, certaines entreprises pourraient préférer des solutions dédiées comme Xero ou QuickBooks.

Easy Month End est-il adapté aux très petites entreprises ou aux travailleurs indépendants ?

Easy Month End est plus avantageux pour les petites entreprises ou les équipes qui disposent d'un processus de clôture mensuelle structuré. Les indépendants ou les très petites entreprises aux besoins plus simples pourraient trouver FreshBooks plus complet pour leur gestion financière globale.

Ces plateformes aident-elles à préparer les déclarations de revenus ?

Les deux plateformes fournissent des rapports utiles à la préparation des déclarations fiscales, tels que les comptes de résultat. Cependant, aucune ne propose de service de déclaration directe. Vous utiliserez généralement leurs données financières pour votre comptable ou votre logiciel fiscal.

Y a-t-il des frais cachés avec FreshBooks par rapport à Easy Month End ?

Les deux solutions présentent clairement leurs tarifs. FreshBooks facture chaque utilisateur supplémentaire et applique des frais de transaction pour les paiements en ligne. Le prix d'Easy Month End™ est modulable en fonction de la taille de l'équipe et du nombre d'entités ; consultez donc toujours les détails de chaque formule pour obtenir des réponses aux questions fréquentes.