Are you struggling to keep track of your money?

Do you want to take control of your finances but feel overwhelmed by all the options out there?

Many people face this problem, and picking the right tool can hacer Una gran diferencia.

In 2025, two popular finance software options are Refreshme vs Quicken.

Both promise to help you manage your money better, but they do it in different ways.

Descripción general

We looked at both Refreshme and Quicken very closely.

Probamos sus características.

This helped us see how they compare for managing your money.

¡Descubre información financiera más completa! Refresh Me analiza tus gastos y te ayuda a ahorrar de forma más inteligente.

¡Pruébalo ahora!

Precios: Tiene una prueba gratuita. El plan premium cuesta $24.99 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

¿Quieres controlar tus finanzas? Con Quicken, puedes conectarte con miles de instituciones financieras. ¡Explora la plataforma para saber más!

Precios: Tiene una prueba gratuita. El plan premium cuesta $5.59 al mes.

Características principales:

- Herramientas de presupuestación

- Gestión de facturas

- Seguimiento de inversiones

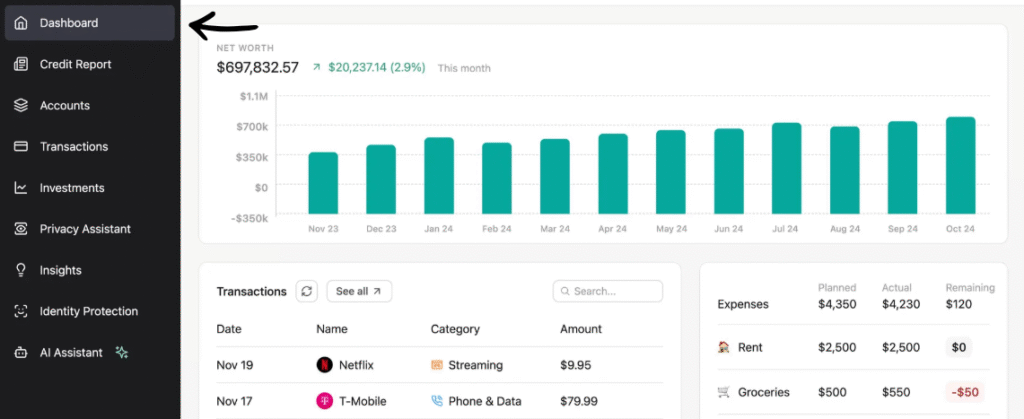

¿Qué es RefreshMe?

RefreshMe es una herramienta que le ayudará a realizar un seguimiento de sus gastos.

Puede ayudarle a mantener sus recibos en un solo lugar. También le ayuda a ver a dónde va su dinero.

Intenta hacer que el seguimiento de gastos sea sencillo para todos.

Además, explora nuestros favoritos Alternativas de Refreshme…

Nuestra opinión

La fortaleza de RefreshMe reside en proporcionar información práctica y en tiempo real. Sin embargo, la falta de precios públicos y la posible falta de funcionalidades contables básicas completas podrían ser un factor a considerar para algunos usuarios.

Beneficios clave

- Paneles financieros en tiempo real

- Detección de anomalías impulsada por IA

- Informes personalizables

- Previsión del flujo de caja

- Evaluación comparativa del rendimiento

Precios

- Individual (3B): $24,99/mes.

- Pareja (3B): $44,99/mes.

Ventajas

Contras

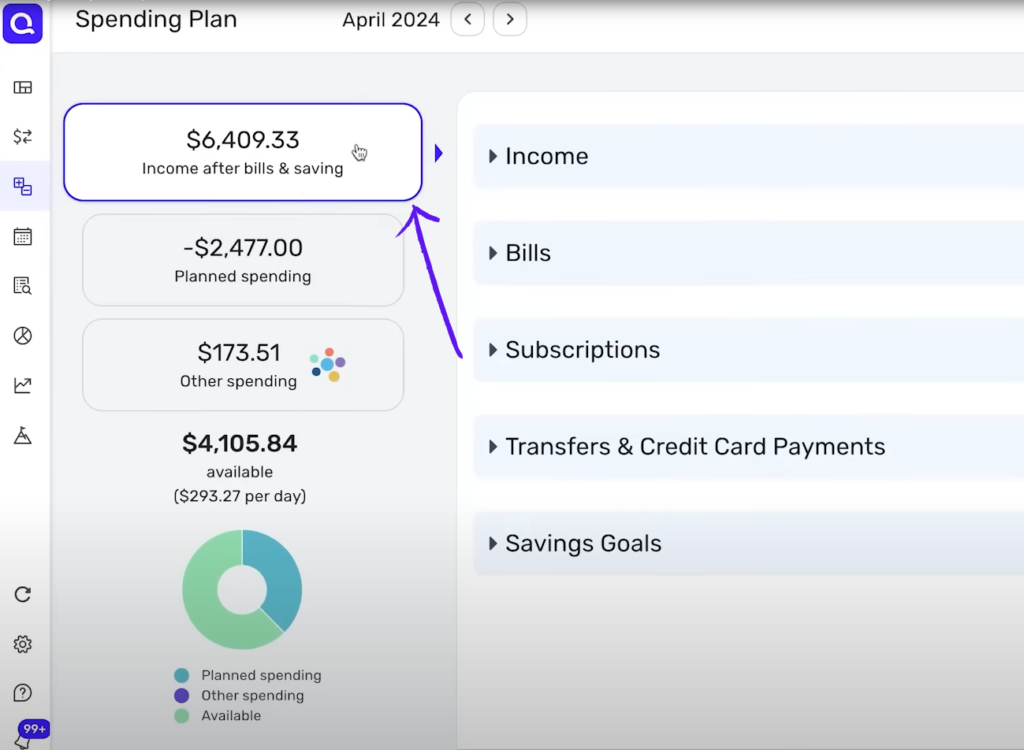

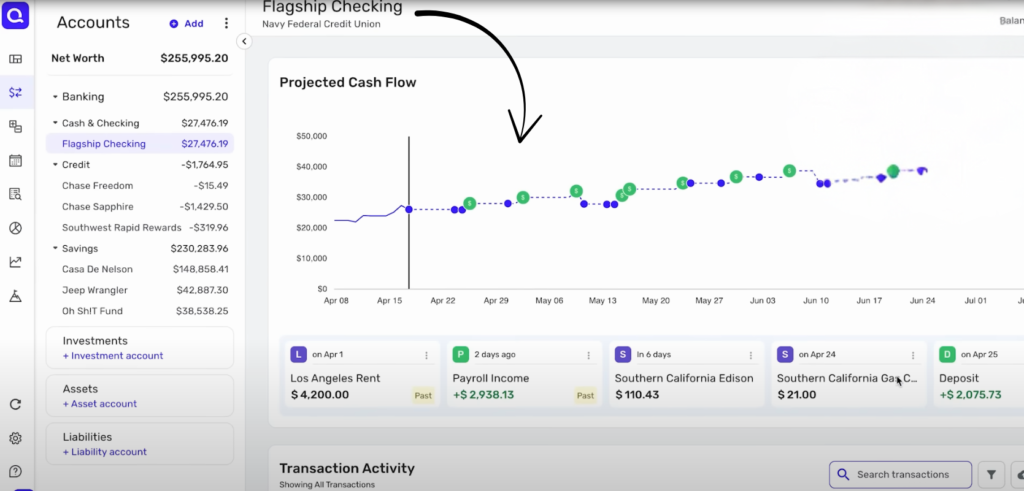

¿Qué es Quicken?

Entonces, ¿te estás preguntando acerca de Quicken?

It’s like a tool that helps you see all your money stuff in one place. Think of it as your digital money organizer.

Puede ayudarle a realizar un seguimiento de sus cuentas bancarias, facturas e incluso inversiones.

Bastante útil, ¿verdad?

Además, explora nuestros favoritos Alternativas de Quicken…

Beneficios clave

Quicken es una herramienta poderosa para poner en orden tu vida financiera.

Cuentan con más de 40 años de experiencia y han sido un producto número 1 en ventas.

Sus diversos planes pueden conectarse con más de 14.500 instituciones financieras.

También puede obtener una garantía de devolución de dinero de 30 días para probarlo sin riesgos.

- Se conecta con miles de bancos y tarjetas de crédito.

- Crea presupuestos detallados.

- Realiza un seguimiento de las inversiones y el patrimonio neto.

- Ofrece herramientas de planificación de la jubilación.

Precios

- Quicken Simplifi: $2,99/mes.

Ventajas

Contras

Comparación de características

Selecting personal finance software requires evaluating a platform’s depth and services.

This Feature Comparison of Refreshme and Quicken breaks down the difference between modern AI-driven simplicity and decades of comprehensive financial planning functionality.

1. Platform Focus and Business Use

- Refrescarme: This is a pure personal finance software that helps clients collect datos to track expenses and improve their financial treatment. It is not designed for small business contabilidad, but for personal use.

- Acelerar: The quicken brand offers plans like quicken business and personal (and the quicken business & personal plan) which allow users to manage alquiler properties and business finances alongside personal accounts. It’s the best contabilidad software for a full picture.

2. Software Architecture and Access

- Refrescarme: It is cloud-based, accessible via mobile app, and requires an internet connection. The user interface is continually updated to improve the clients’ experience, and you can access the services easily.

- Acelerar: It is historically self hosted/on premise software, running primarily on windows and impermeable desktop systems, though it offers limited mobile and download access now. This age of design is a key difference.

3. Investment and Retirement Planning

- Refrescarme: It offers basic investment monitoring to refresh your knowledge of your balances and profit.

- Acelerar: The quicken premier and quicken deluxe tiers offer advanced retirement planning and sophisticated analysis of investment portfolios. It is built to manage complex financial assets and project future balances.

4. Cost and Licensing Model

- Refrescarme: The price is typically a budget-friendly, low-cost subscription with clear billing period terms.

- Acelerar: The price has shifted entirely to a subscription model and often includes add-on fees. The core quicken software is a high cost upfront and comes in different versions (deluxe, premier) with varying functionality.

5. Content, Reviews, and Support

- Refrescarme: Reviews note its modern content and AI-driven treatment plans. The content is easily digestible and geared to improve basic financial literacy for clients.

- Acelerar: The quicken review highlights decades of comprehensive content and a large community. This history provides vast information, even though some reviews note that support team quality has failed to match the software’s depth.

6. Transaction Tracking and Entry

- Refrescarme: It helps clients collect bank transactions and uses cookies for easy login. The automatización saves time by automatically entering transactions to refresh the dashboard.

- Acelerar: It has robust features to collect bank transactions and enter manual transactions. Quicken software allows for longer transaction history and greater detail in financial records.

7. Budgeting and Cash Flow

- Refrescarme: It is a simple tool for budgeting tools and gives a quick review of cash flow. The primary goal is to improve spending habits.

- Acelerar: It offers more traditional, detailed budgeting tools that allow every users to analyze historical data & forecast future cash flow. The quicken deluxe version provides enhanced reportando for deeper analysis.

8. Business and Tax Functionality

- Refrescarme: It is strictly personal finance software and has no ability to send invoices or handle sales tax.

- Acelerar: The Quicken Premier and Quicken Business & Personal plans offer sales tax tracking, run payroll, send invoices, and accounts receivable features, providing a full picture for the self employed.

9. User Experience and Design

- Refrescame: Its user interface is often described as modern and clean, with a clear focus on the personal financial picture change from the beginning.

- Acelerar: Its user interface can be complex, but the quicken software is designed to provide key features for every personal planning need, offering services for every age and financial art stage.

10. Bill Management and Market Alternatives

- Refrescarme: This platform’s services include robust bill tracking and management, helping clients monitor upcoming payments to maintain cash flow. It aims to be a modern personal finance software alternative in the current market.

- Acelerar: The quicken home and quicken deluxe versions have dedicated features to connect with vendors and pay bills directly. Users can easily create and forecast future income and explore various alternatives in the market for advanced financial planning.

¿Qué buscar en un software de contabilidad?

Aquí hay algunas cosas adicionales que debes tener en cuenta:

- Escalabilidad: Can the services change with your clients? If you need to track mileage and manage purchase orders, the process must be perfect and remain secure for a longer date. Aquiline capital partners often analyze software based on its value for long-term growth and payments handling.

- Apoyo: What kind of help is available if you have questions? You should review vendors and their support dates to see how quickly they refresh their system when a financial transaction has failed. The difference in treatment is clear: good support must offer information immediately to clients.

- Facilidad de uso¿Es algo que usted y su equipo pueden aprender rápidamente? Expensificar permite ingresar fácilmente una foto y registrar el kilometraje desde su bolsillo, pero la versión de escritorio de QuickBooks puede ser más difícil de dominar para un gerente nuevo.

- Necesidades específicas: Does it handle the unique things your business does? Does the treatment of clients change based on their age? Does the software manage expenses for a small number of users and allow you to track mileage and purchase orders with tags?

- Seguridad: How safe is your financial data with this software? The face of security is constantly updated. The expensify card provides real time security, but you should always review stored data. The difference in art is clear: simple interfaces are less likely to fail than every complex ones, and they help employers approve requests to manage expenses.

Veredicto final

So, which one wins: Refreshme or Quicken?

For most people wanting a simple way to manage everyday money, Refreshme is a great pick.

It’s easier to use and helps you see your money clearly without lots of complicated features.

However, if you have many investments or need very deep reports, Quicken might be better.

We looked at everything from budgeting to tracking bills and investments.

Our goal is to give you the best advice for su dinero.

Choose the one that fits how tú handle your finances best.

Más de Refreshme

- Refréscame vs Puzzle IO: Este software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Refrescarme vs Dext: Esta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Refrescarme vs Xero: Este es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Refrescarme vs Synder: Esta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Refrescarme vs Fin de mes fácil: Esta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Refrescarme vs Docyt: Este utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Refrescarme vs Sage: Esta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Refrescarme vs Zoho Books: Esta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Refrescarme vs Wave: Este software de contabilidad es gratuito para pequeñas empresas. Su versión está diseñada para particulares.

- Refrescarme vs Quicken: Ambas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Refrescarme vs Hubdoc: Se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Refrescarme vs. Expensify: Esta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Refrescarme vs QuickBooks: Este es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Actualizarme vs Entrada automática: Está diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Refrescarme vs FreshBooks: Este es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Refrescarme vs NetSuite: Esta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de Quicken

- Quicken vs. PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Quicken frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Quicken frente a Xero:Esto es popular en línea. software de contabilidad Para pequeñas empresas. Su competidor es para uso personal.

- Quicken frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Quicken vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Quicken frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Quicken frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Quicken frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Quicken frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Quicken frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Quicken frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Quicken frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Quicken frente a AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Quicken frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Quicken frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

Is Refreshme better for beginners?

Yes, Refreshme is often better for beginners. Its simple design makes it easy to set up and start tracking your spending. It focuses on essential money management without overwhelming features.

Does Quicken offer investment tracking?

Yes, Quicken offers strong investment tracking. It allows you to monitor various investment accounts, analyze performance, and get detailed reports. This makes it suitable for active investors.

Can I link all my bank accounts to both platforms?

Generally, yes, you can link most bank accounts to both Refreshme and Quicken. They aim to consolidate your financial data in one place for a complete overview of your money.

Do Refreshme vs Quicken have mobile apps?

Yes, both Refreshme and Quicken offer mobile apps. This lets you manage your finances on the go from your smartphone or tablet. Their features on mobile might differ slightly from desktop versions.

Which one is more secure for my financial data?

Both Refreshme and Quicken use security measures to protect your financial data. They employ encryption and other safeguards. Always ensure you use strong passwords and practice good online privacy habits.