¿Estás tratando de averiguar cuál? software de contabilidad ¿Es lo mejor para tu negocio?

Puede resultar difícil elegir entre Xero y Sage.

Ambos te ayudan a administrar tu dinero, pero tienen diferentes fortalezas.

En este artículo, analizaremos Xero vs Sage de una manera sencilla.

Analizaremos qué hace mejor cada uno para ayudarle a decidir cuál podría ser el ganador para sus necesidades.

Descripción general

Hemos pasado tiempo explorando tanto Xero como Sage.

Getting a feel for how they work day-to-day.

Nuestra experiencia práctica nos ha permitido ver dónde destaca cada software y dónde podría fallar.

A continuación te presentamos esta comparativa detallada para ayudarte a elegir.

Únase a más de 2 millones de empresas que utilizan el software de contabilidad en la nube de Xero. ¡Explore sus potentes funciones de facturación ahora!

Precios: Tiene una prueba gratuita. El plan pago comienza en $29/mes.

Características principales:

- Conciliación bancaria

- Facturación

- Informes

Más de 6 millones de clientes confían en Sage. Con una calificación de satisfacción del cliente de 56 sobre 100, sus robustas funciones son una solución de eficacia comprobada.

Precios: Prueba gratuita disponible. El plan premium cuesta $66.08 al mes.

Características principales:

- Facturación

- Integración de nóminas

- Gestión de inventario

¿Qué es Xero?

Entonces, estás mirando a Xero, ¿eh?

Es una opción popular para muchos pequeñas empresas.

Piense en ello como su centro en línea para todo lo relacionado con el dinero.

Además, explora nuestros favoritos Alternativas a Xero…

Nuestra opinión

Únase a más de 2 millones de empresas usando Xero Software de contabilidad. ¡Explora sus potentes funciones de facturación ahora!

Beneficios clave

- Conciliación bancaria automatizada

- Facturación y pagos en línea

- Gestión de facturas

- Integración de nóminas

- Informes y análisis

Precios

- Motor de arranque: $29/mes.

- Estándar: $46/mes.

- De primera calidad: $69/mes.

Ventajas

Contras

¿Qué es Sage?

Hablemos de Sage. Lleva bastante tiempo en el mercado.

Muchas empresas confían en él para sus contabilidad.

Gestiona facturas y pagos, además de facilitar la gestión del inventario.

Además, explora nuestros favoritos Alternativas a la salvia…

Nuestra opinión

¿Listo para optimizar tus finanzas? Los usuarios de Sage han reportado un aumento promedio del 73 % en la productividad y una reducción del 75 % en el tiempo de procesamiento.

Beneficios clave

- Facturación y pagos automatizados

- Informes financieros en tiempo real

- Fuerte seguridad para proteger los datos

- Integración con otras herramientas empresariales

- Soluciones de nómina y RRHH

Precios

- Contabilidad profesional: $66.08/mes.

- Contabilidad Premium: $114.33/mes.

- Contabilidad cuántica: $198.42/mes.

- Paquetes de RRHH y nómina: Precios personalizados según sus necesidades.

Ventajas

Contras

Comparación de características

Necesitamos profundizar en las funciones específicas de cada herramienta.

Esta comparación aclarará cuál contabilidad La plataforma se alinea mejor con su gestión de flujo de trabajo existente y si el software de contabilidad Xero o la contabilidad en la nube de Sage Business se adaptan mejor a su situación financiera.

1. Acceso y diseño basados en la nube

- XeroEsta es una solución verdaderamente basada en la nube. El panel de Xero es claro e intuitivo, lo que lo convierte en uno de los favoritos de... pequeña empresa propietarios y reduce la necesidad de capacitación exhaustiva. Xero se destaca por brindar una experiencia moderna y fácil de usar, incluso para quienes se inician en las tareas financieras.

- Sabio:Si bien Sage Business Cloud Accounting ofrece una opción en la nube, Sage también tiene software de escritorio (como Sage 50) que puede tener limitaciones. acceso remoto Sin configuración adicional. Su diseño suele ser adecuado para quienes prefieren un enfoque más tradicional y detallado.

2. Banca y conciliación

- XeroXero le permite conectar sus cuentas bancarias mediante datos bancarios automáticos. El proceso de conciliación bancaria, rápido y altamente automatizado para las transacciones bancarias diarias, es uno de los puntos fuertes de Xero, ya que reduce significativamente la necesidad de realizar operaciones manuales. datos entrada.

- SabioSage Business Cloud también permite vincular cuentas bancarias e importar transacciones bancarias. Sin embargo, los usuarios suelen encontrar... automatización y capacidades de establecimiento de normas para ser más eficientes en la reducción de diferencias no conciliadas.

3. Cuentas por pagar

- Xero: The xero software de contabilidad includes strong accounts payable functionality. The early and growing plans allow you to track up to five bills and then unlimited invoices (bills). You can also capture bills and receipts easily.

- SabioLa contabilidad empresarial en la nube de Sage incluye seguimiento de facturas y funciones de cuentas por pagar. Permite a las empresas gestionar sus facturas y programar pagos, aunque Xero suele ofrecer una automatización algo más sencilla para este proceso.

4. Gestión de inventario

- XeroEl software de contabilidad Xero incluye una gestión básica de inventario en sus planes de gama alta, ideal para el seguimiento sencillo de productos. Sin embargo, no se considera una herramienta completa de planificación de recursos empresariales (ERP).

- SabioSage ofrece una gestión de inventario robusta en sus planes más avanzados, lo que permite crear variantes de productos, realizar un seguimiento de los datos de inventario, emitir alertas de stock bajo y gestionar múltiples ubicaciones. Esto convierte a Sage en una mejor opción para empresas que operan con productos y en expansión.

5. Facturación y cuentas por cobrar

- XeroXero facilita el envío de facturas en línea y el seguimiento de las facturas pendientes (cuentas por cobrar). Xero permite enviar facturas ilimitadas con los planes Crecimiento y Establecido, lo cual es ideal para servicios profesionales y contratistas independientes.

- SabioSage Business Cloud es excelente para crear y enviar facturas de venta profesionales. El sistema le ayuda a gestionar sus datos financieros y a gestionar los pagos pendientes, garantizando un mejor control de las cuentas por cobrar.

6. Captura de gastos y facturas

- XeroXero destaca en el seguimiento de gastos y la gestión de costos. Puede usar su aplicación móvil para registrar fácilmente facturas y recibos, lo que ayuda a los propietarios de pequeñas empresas a mantener registros financieros precisos sin necesidad de introducir muchos datos manualmente.

- Sabio:Sage Business Cloud ofrece herramientas de gestión de gastos y funciones como Entrada automática (a menudo disponible como complemento o a través de Sage Marketplace) puede ayudar a automatizar la captura de facturas y recibos para un mantenimiento de registros más sencillo.

7. Información financiera

- Xero: Xero reportando Las funciones son potentes, ya que proporcionan datos en tiempo real sobre el rendimiento empresarial y ayudan a evaluar la situación financiera. Los informes son muy visuales y fáciles de usar, ideales para usuarios sin conocimientos de contabilidad.

- Sage: Sage ofrece amplias opciones para generar informes, a menudo ofreciendo informes financieros más profundos y tradicionales, preferidos por equipos contables experimentados. Esta profundidad es vital para empresas consolidadas que requieren análisis complejos.

8. Experiencia de la aplicación móvil

- Xero: La aplicación móvil para iOS Y la compatibilidad con dispositivos Android es excelente. Xero permite gestionar la facturación, los gastos y las operaciones bancarias desde cualquier lugar. Esta accesibilidad es una gran ventaja para los pequeños empresarios con mucha actividad.

- Sage: Sage Business Cloud ofrece una aplicación móvil dedicada, pero algunos usuarios informan limitaciones en el acceso móvil en cuanto a funcionalidad en comparación con la solución de escritorio completa o la aplicación más optimizada de Xero.

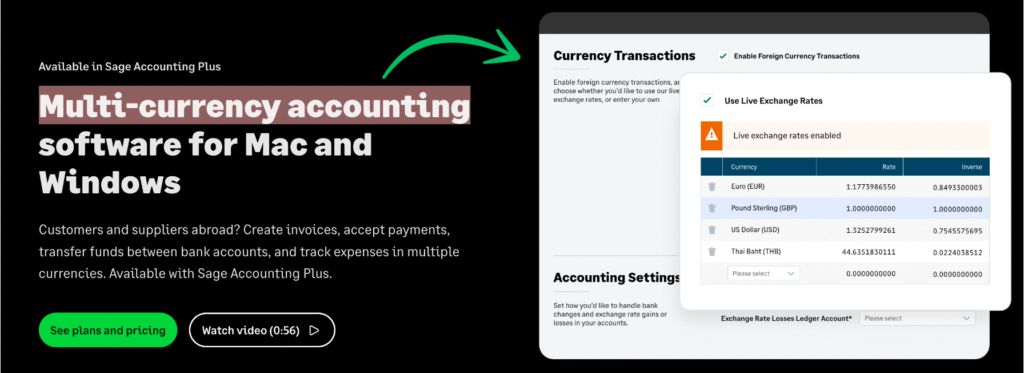

9. Multidivisa y ERP

- Xero: El plan establecido del software de contabilidad Xero incluye compatibilidad con múltiples divisas, lo cual es ideal para empresas en expansión. Xero funciona bien como herramienta de contabilidad básica, pero requiere integraciones para funcionar como una solución completa de planificación de recursos empresariales (ERP).

- Sage: Los productos Sage de gama alta ofrecen un amplio soporte multidivisa. Los productos más robustos de Sage (como Sage 200 o Intacct) se acercan a ofrecer las funciones de planificación de recursos empresariales que necesitan las empresas consolidadas con requisitos complejos de gestión de ventas e inventario.

¿Qué tener en cuenta al elegir un software de contabilidad?

Elegir la herramienta adecuada para la gestión financiera y el crecimiento de su negocio implica ir más allá de lo básico. Considere estos importantes consejos para evitar posibles inconvenientes y garantizar que la solución sea la más adecuada:

- Costos y planes de Xero:Si bien Xero ofrece usuarios ilimitados, es necesario verificar cuidadosamente los precios y el costo de Xero. El plan inicial y otros planes de precios limitan funciones clave como la cantidad de facturas que puede procesar.

- La curva de aprendizaje de SageSage puede ser ideal para empresas medianas que necesitan funciones avanzadas, como el cálculo de costes de trabajo con códigos de coste, pero su interfaz no es tan sencilla como la de Xero. El aprendizaje necesario puede ser un inconveniente.

- Automatización de inventarioSi vende productos, compruebe si el software puede sincronizar el inventario automáticamente. Sage suele tener funciones de gestión de inventario integradas más potentes que los complementos ERP del software de contabilidad Xero.

- Datos e informes en tiempo realExija siempre informes en tiempo real. Xero ofrece informes altamente personalizables para comprobar la salud financiera y el flujo de caja de su empresa.

- Support and LearningSage ofrece Sage University para capacitación exhaustiva y un centro comunitario para responder preguntas y resolver problemas. Esto es una ventaja si necesita más ayuda.

- Conectividad y copias de seguridadAmbos son programas de contabilidad basados en la nube y requieren una conexión a internet estable. Asegúrese de que el sistema incluya copias de seguridad en línea y una sólida... seguridad para sus datos financieros.

- Solución de nómina¿Incluye software de nómina? Debe comparar Sage Payroll con el complemento de Xero para ver qué sistema simplifica mejor su nómina y declaración de impuestos.

- Migración de datos¿Tiene datos contables existentes? Pregúntele al proveedor qué tan fácil es cambiar y transferir de forma segura sus registros únicos para ahorrar tiempo.

- Seguimiento de proyectos y compras:Si gestiona proyectos, confirme las funciones de seguimiento de proyectos y si puede crear y gestionar fácilmente órdenes de compra directamente en la plataforma.

Veredicto final

Tras este análisis profundo, recomendamos con confianza Xero para la mayoría de las empresas en crecimiento. ¿Por qué?

La revisión del software de contabilidad Xero elogia constantemente su facilidad de gestión del flujo de caja y la experiencia del usuario.

Está diseñado para la conectividad en la nube, lo que le permite administrar sus finanzas de manera efectiva sin tareas manuales complejas.

Si bien Sage ofrece funciones de contabilidad profesionales y maneja mejor escenarios complejos, use Xero si su objetivo es la simplicidad y un funcionamiento perfecto.

No se preocupe por el soporte; Xero Central y otros recursos en línea son excelentes.

Si bien algunos planes avanzados tienen precios más altos, el valor es claro.

Puedes probar Xero tú mismo con una versión de prueba.

Es la opción más inteligente frente a alternativas como QuickBooks En línea para equipos modernos y ágiles enfocados en escalar, sin perderse en menús.

Más de Xero

Elegir el software de contabilidad adecuado implica considerar varias opciones.

He aquí una rápida comparación entre Xero y otros productos populares.

- Xero frente a QuickBooks: QuickBooks es un competidor importante. Si bien ambos ofrecen funciones básicas similares, Xero suele ser elogiado por su interfaz clara y su número ilimitado de usuarios. QuickBooks puede ser más complejo, pero ofrece informes muy eficaces.

- Xero frente a FreshBooks: FreshBooks es una opción popular, especialmente para autónomos y empresas de servicios. Destaca por su facturación y control de horas trabajadas. Xero ofrece una solución de contabilidad más completa.

- Xero frente a Sage: Tanto Sage como Xero ofrecen soluciones para pequeñas empresas. Sin embargo, Sage también proporciona herramientas de planificación de recursos empresariales (ERP) más completas para empresas más grandes.

- Xero vs. Zoho Books: Zoho Books forma parte de una amplia gama de aplicaciones empresariales. Suele ofrecer funciones de inventario más avanzadas y es muy rentable. Xero, por su parte, es una opción líder por su simplicidad y facilidad de uso.

- Xero frente a Wave: Wave es conocido por su plan gratuito. Es una excelente opción para pequeñas empresas o autónomos con un presupuesto ajustado. Xero ofrece una gama más amplia de funciones y es ideal para el crecimiento empresarial.

- Xero frente a Quicken: Quicken se centra principalmente en finanzas personales. Si bien ofrece algunas funciones empresariales, no es una auténtica solución de contabilidad empresarial. Xero está diseñado específicamente para gestionar las complejidades de la contabilidad empresarial.

- Xero frente a HubdocEstos no son competidores directos. Tanto Dext como Hubdoc son herramientas que automatizan la captura de documentos y la entrada de datos. Se integran directamente con Xero para agilizar y hacer más precisa la contabilidad.

- Xero frente a Synder: Synder es una plataforma que conecta canales de venta y pasarelas de pago con software de contabilidad. Ayuda a automatizar la entrada de datos desde plataformas como Shopify y Stripe directamente a Xero.

- Xero frente a ExpensifyExpensify se centra específicamente en la gestión de gastos. Si bien Xero cuenta con funciones de gastos, Expensify ofrece herramientas más avanzadas para gestionar los gastos y reembolsos de los empleados.

- Xero frente a Netsuite: Netsuite es un sistema ERP integral para grandes corporaciones. Ofrece un conjunto completo de herramientas de gestión empresarial. Xero no es un ERP, pero es una excelente solución de contabilidad para pequeñas empresas.

- Xero frente a Puzzle IO: Puzzle IO es una plataforma financiera diseñada para empresas emergentes, centrada en estados financieros en tiempo real y entrada de datos automatizada.

- Xero vs. Easy Month End: Este software es una herramienta especializada para automatizar el proceso de cierre de mes, facilitando la conciliación y los registros de auditoría. Está diseñado para funcionar con Xero, no para reemplazarlo.

- Xero frente a Docyt: Docyt utiliza IA para automatizar las tareas administrativas y de contabilidad. Permite consultar todos sus documentos y datos financieros en un solo lugar.

- Xero frente a RefreshMe: RefreshMe es un software de contabilidad más simple con funciones básicas, a menudo utilizado para finanzas personales o empresas muy pequeñas.

- Xero frente a AutoEntry: Similar a Dext y Hubdoc, AutoEntry es una herramienta que automatiza la extracción de datos de recibos y facturas, diseñada para integrarse y mejorar el software de contabilidad como Xero.

Más de Sage

Es útil ver cómo se compara Sage con otro software popular.

A continuación se muestra una breve comparación con algunos de sus competidores.

- Sage vs Puzzle IO: Si bien ambos se encargan de la contabilidad, Puzzle IO está diseñado específicamente para empresas emergentes y se centra en el flujo de caja en tiempo real y en métricas como la tasa de consumo.

- Sage contra Dext: Dext es principalmente una herramienta para automatizar la captura de datos de recibos y facturas. Suele funcionar junto con Sage para agilizar la contabilidad.

- Sage frente a Xero: Xero es una opción basada en la nube conocida por su facilidad de uso, especialmente para pequeñas empresas. Sage puede ofrecer funciones más robustas a medida que la empresa crece.

- Sage contra Synder: Synder se centra en sincronizar plataformas de comercio electrónico y sistemas de pago con software de contabilidad como Sage.

- Fin de mes sabio vs. fácil: Este software es un administrador de tareas que le ayuda a realizar un seguimiento de todos los pasos necesarios para cerrar sus libros al final del mes.

- Sage contra Docyt: Docyt utiliza IA para automatizar la contabilidad y eliminar la entrada manual de datos, proporcionando una alternativa altamente automatizada a los sistemas tradicionales.

- Sage vs. RefreshMe: RefreshMe no es un competidor directo de contabilidad. Se centra más en el reconocimiento y el compromiso de los empleados.

- Sage vs. Zoho Books: Zoho Books forma parte de una amplia gama de aplicaciones empresariales. Recibe elogios por su diseño limpio y sus sólidas conexiones con otros productos de Zoho.

- Sage vs Wave: Wave es conocido por su plan gratuito, que ofrece contabilidad y facturación básicas, lo que lo convierte en una opción popular para trabajadores independientes y empresas muy pequeñas.

- Sage frente a Quicken: Quicken está más orientado a las finanzas personales o de empresas muy pequeñas. Sabio ofrece funciones más sólidas para un negocio en crecimiento, como nómina e inventario avanzado.

- Sage contra Hubdoc: Hubdoc es una herramienta de gestión documental que recopila y organiza automáticamente documentos financieros, similar a Dext, y puede integrarse con plataformas de contabilidad.

- Sage frente a Expensify: Expensify es experto en la gestión de gastos. Es ideal para escanear recibos y automatizar los informes de gastos de los empleados.

- Sage frente a QuickBooks: QuickBooks es una plataforma líder en el sector contable para pequeñas empresas. Es conocido por su interfaz intuitiva y su amplia gama de funciones.

- Sage vs. AutoEntry: Esta es otra herramienta que automatiza la entrada de datos de recibos y facturas. Funciona bien como complemento de software de contabilidad como Sabio.

- Sage frente a FreshBooks: FreshBooks es especialmente bueno para trabajadores independientes y empresas de servicios, con un enfoque en la facturación simple y el seguimiento del tiempo.

- Sage frente a NetSuite: NetSuite es un sistema ERP a gran escala para empresas grandes. Sabio tiene una gama de productos, algunos de los cuales compiten en este nivel, pero NetSuite es una solución más grande y más compleja.

Preguntas frecuentes

¿Es Xero mejor que Sage para las pequeñas empresas?

Xero suele ser el preferido por su interfaz intuitiva y escalabilidad para pequeñas empresas. Sage puede ser más adecuado para empresas más grandes con necesidades complejas.

¿Puede mi contador trabajar con Xero y Sage?

Sí, la mayoría de los contadores están familiarizados con Xero y Sage. La mejor opción varía según los requisitos específicos de su negocio y las preferencias de su contador.

¿Qué software de contabilidad ofrece una mejor atención al cliente?

Las opiniones de los usuarios sobre la atención al cliente varían en ambos casos. Es recomendable consultar los comentarios recientes y considerar el nivel de soporte que ofrece cada uno en tu región.

¿Es difícil cambiar de un software de contabilidad a otro?

El cambio puede requerir tiempo y planificación. Tanto Xero como Sage ofrecen herramientas de migración de datos, pero es recomendable involucrar a su contable en el proceso.

¿Qué software de contabilidad tiene más integraciones con otras aplicaciones empresariales?

Xero generalmente cuenta con un mercado más grande de integraciones con varias aplicaciones comerciales de terceros en comparación con Sage.