¿Estás cansado de pasar demasiado tiempo cerrando tus libros cada mes?

Puede parecer un rompecabezas sin fin, ¿verdad?

Es por eso que vamos a analizar dos herramientas populares: Synder vs Easy Month End.

Ambos prometen simplificar su cierre financiero, pero ¿cuál lo cumple realmente?

Echemos un vistazo más de cerca y descubramos cuál podría ser la mejor opción para usted.

Descripción general

Analizamos de cerca tanto Synder como Easy Month End.

Los probamos para ver qué tan bien funcionan.

Esto nos ayuda a compararlos de manera justa para usted. Ahora, veamos de qué se trata cada uno.

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $52 al mes.

Características principales:

- Sincronización de ventas multicanal

- Conciliación automatizada

- Informes detallados

Este fin de mes fácil, únete a 1257 usuarios que ahorraron un promedio de 3,5 horas y redujeron los errores en un 15 %. ¡Comienza tu prueba gratuita!

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $45 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

¿Qué es Synder?

Hablemos de Synder.

Es una herramienta que te ayuda a diferentes negocio Las aplicaciones se comunican entre sí.

Piense en ello como un ayudante que mueve la información de su dinero a donde debe ir.

Esto puede ahorrarle mucho tiempo.

Además, explora nuestros favoritos Alternativas a Synder…

Nuestra opinión

Synder automatiza su contabilidad, sincronizando los datos de ventas sin problemas con QuickBooks, XeroY más. Las empresas que utilizan Synder informan que ahorran un promedio de más de 10 horas por semana.

Beneficios clave

- Sincronización automática de datos de ventas

- Seguimiento de ventas multicanal

- Conciliación de pagos

- Integración de la gestión de inventario

- Informes de ventas detallados

Precios

Todos los planes se cumplirán Facturado anualmente.

- Básico: $52/mes.

- Básico: $92/mes.

- Pro: $220/mes.

- De primera calidad: Precios personalizados.

Ventajas

Contras

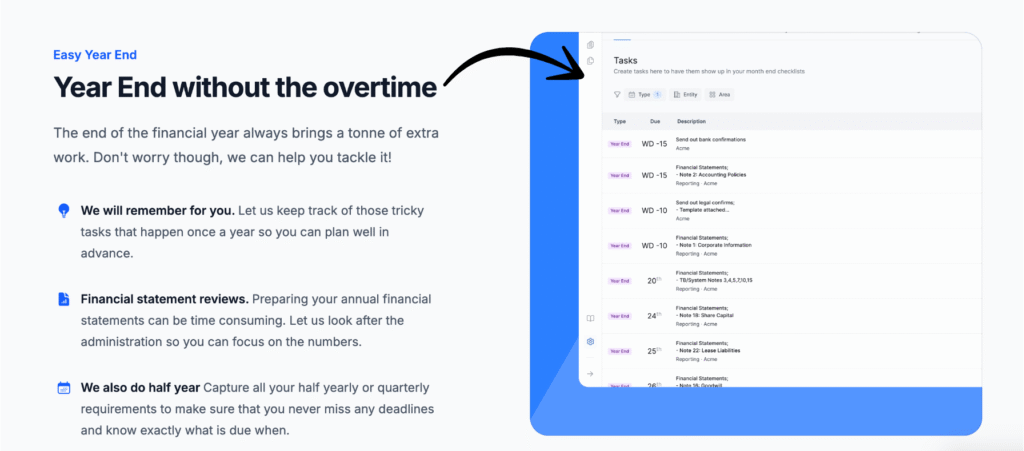

¿Qué es Easy Month End?

Entonces, Easy Month End es como un ayudante para cuando termina el mes.

Intenta hacer cerrar tus libros más fácilmente.

Piense en ello como una forma de mantener todo su dinero en un solo lugar al final del mes.

Le ayuda a ver cuánto dinero entró y cuánto salió.

Además, explora nuestros favoritos Alternativas fáciles para el fin de mes…

Nuestra opinión

Aumente la precisión financiera con Easy Month End. Aproveche la conciliación automatizada y los informes listos para auditoría. Programe una demostración personalizada para optimizar su proceso de cierre de mes.

Beneficios clave

- Flujos de trabajo de conciliación automatizados

- Gestión y seguimiento de tareas

- Análisis de varianza

- Gestión de documentos

- Herramientas de colaboración

Precios

- Motor de arranque:$24/mes.

- Pequeño: $45/mes.

- Compañía: $89/mes.

- Empresa: Precios personalizados.

Ventajas

Contras

Comparación de características

Veamos qué hace cada programa. Los compararemos en función de nueve características clave.

Esto te ayudará a ver la verdad sobre cada uno.

1. Conexión de sus canales de venta

- Synder es ideal para conectar todos tus canales de ventas.

- Puede sincronizarse con plataformas como Shopify, Stripe, PayPal y Square.

- Esto le permite traer transacciones históricas y nuevas ventas. datos en una sola plataforma.

- Easy Month End se centra más en la gestión del flujo de trabajo.

- Se conecta a menos plataformas de ventas.

2. Conciliación y automatización

- Synder ofrece automatización contabilidad.

- Ayuda a conciliar sus datos de múltiples lugares.

- Facilita la conciliación, reduciendo las confirmaciones manuales.

- Generalmente este es un proceso que requiere un solo clic.

- Easy Month End le ayuda a gestionar las tareas de fin de mes.

- Le ayuda a administrar y revisar todas sus conciliaciones.

3. Colaboración en equipo

- Easy Month End está diseñado para equipos de finanzas.

- Tiene funciones como "dejar comentarios", "aprobaciones" y gestión de equipos.

- Esto hace que su equipo trabaje en conjunto sin problemas.

- Hace que el proceso de fin de mes sea más eficiente.

- Synder también apoya el trabajo en equipo.

- El enfoque principal de Easy Month End está en la colaboración en equipo y la gestión del flujo de trabajo.

4. Datos e informes

- Synder brinda detalles como tarifas, envíos, reembolsos y descuentos.

- Ayuda a mantener sus libros equilibrados.

- Easy Month End es una excelente opción para crear balances generales.

- Te ayuda a recolectar auditoría evidencia para los auditores.

- Esto ayuda a reducir el estrés al final del trimestre y del año.

- Está diseñado para conciliaciones de balances más rápidas.

5. Multicanal y alto volumen

- Synder es una opción sólida para las ventas multicanal.

- Está diseñado para gestionar transacciones de gran volumen desde muchos lugares.

- También gestiona ventas multidivisa.

- Easy Month End se centra más en el flujo de trabajo del equipo de finanzas.

- Ayuda al equipo de finanzas a llevar una vida más sencilla al agilizar las tareas.

6. Compatibilidad del sistema contable

- Synder trabaja con las principales contabilidad programas.

- Estos incluyen QuickBooks, QuickBooks Online, Xero y Sabio Intacto.

- Esto hace que sea fácil de configurar.

- Easy Month End también es compatible con muchos de estos sistemas.

7. Tarifas y precios

- La tarifa total que pague dependerá de sus necesidades.

- En el caso de Synder, es posible que se le cobre según la cantidad de transacciones que tenga.

- Easy Month End también tiene diferentes niveles para sus suscripciones.

8. Manejo de errores y seguridad

- Synder le ayuda a resolver errores y equivocaciones de forma automática.

- Tiene una función de modo de sincronización que puede detectar problemas.

- Ambos programas garantizan seguridad.

- Esto le ayuda a estar seguro de que sus datos financieros están seguros.

- Su objetivo es el cumplimiento de los PCGA.

9. Configuración y facilidad de uso

- La configuración inicial de Synder es sencilla.

- Puedes conectar plataformas como Etsy y Clover.

- Easy Month End promete una vida más fácil con una configuración rápida.

- Te ayuda a empezar tu primer fin de mes sin problemas.

- Facilita el proceso de fin de mes.

¿Qué tener en cuenta al elegir un software de contabilidad?

Esto es lo que debes comprobar para asegurarte de obtener la herramienta adecuada:

- ¿Mejora la eficiencia y facilita las tareas de tu equipo financiero? Un equipo financiero más eficiente merece herramientas que automaticen y reduzcan el trabajo manual.

- Comprueba su capacidad para gestionar las ventas de comercio electrónico, incluyendo plataformas como eBay, y la correcta gestión de los pagos.

- Vea si puede sincronizar datos de todos sus canales de ventas y sistemas de pago.

- Si tiene suscripciones, busque funciones sólidas de reconocimiento de ingresos. Esto es importante para el cumplimiento de los PCGA.

- ¿El sistema gestiona bien el inventario y los clientes, proporcionándole información clara?

- Verifique que el sistema se centre en el proceso de cierre de mes. ¿Promete un cierre de mes más fluido?

- Busque funciones que simplifiquen las tareas del equipo de finanzas, como la colaboración en equipo y la fácil asignación de tareas.

- ¿Ofrece un complemento de Outlook o una forma similar para acceder rápidamente a las tareas?

- ¿Puede cargar e importar fácilmente datos, como contratos y otros archivos, a la plataforma?

- Comprueba si puedes responder preguntas y dejar comentarios directamente en el sistema. Esto facilita la auditoría.

- ¿La herramienta maneja correctamente los detalles de transferencia bancaria?

- Verificar la flexibilidad para tareas ad hoc y revisión de cuentas.

- ¿Puede gestionar múltiples entidades comerciales y cancelar suscripciones fácilmente si es necesario?

- Vea lo bien que funciona con QuickBooks, Xero, NetSuite, o Salvia Intacta.

- ¿Puede el preparador completar el trabajo y enviarlo para revisión sin demoras?

- Debería ofrecer una forma sencilla de cambiar o abandonar métodos antiguos, como trabajar en Excel.

- Busque características que hagan que el teneduría de libros Fondo fácil de entender.

- ¿El software ofrece una vista ampliada de sus datos para una mejor toma de decisiones?

- Verifique si proporciona una identificación única o un número de seguimiento para las transacciones.

- ¿La empresa (por ejemplo, una con sede en San Francisco) es conocida y confiable?

- Debería alegrarse de que los usuarios envíen información rápidamente, la cual el sistema debería haber resaltado como completada.

Veredicto final

Entonces, analizamos tanto Synder como Easy Month End.

Si realiza muchas ventas en línea y desea realizar un seguimiento de cada transacción y ordenar sus libros fácilmente.

Synder es una muy buena elección.

Ayuda a conectar diferentes programas e incluso puede ayudar con información fiscal.

Easy Month End es útil para mantener organizadas tus tareas de fin de mes.

Los hemos probado, así que sabemos de lo que estamos hablando.

Si quieres simplificar tu vida financiera, ¡prueba Synder!

Más de Synder

- Synder contra Puzzle io: Puzzle.io es una herramienta de contabilidad basada en IA diseñada para startups, centrada en métricas como la tasa de consumo y el recorrido de la inversión. Synder se centra más en la sincronización de datos de ventas multicanal para una gama más amplia de negocios.

- Synder contra Dext: Dext es una herramienta de automatización que destaca por capturar y gestionar datos de facturas y recibos. Synder, por otro lado, se especializa en automatizar el flujo de transacciones de ventas.

- Synder frente a Xero: Xero es una plataforma de contabilidad en la nube con todas las funciones. Synder trabaja con Xero para automatizar la entrada de datos de los canales de ventas, mientras que Xero maneja tareas contables todo en uno, como facturación e informes.

- Synder vs Easy Month End: Easy Month End es una herramienta diseñada para ayudar a las empresas a organizar y optimizar su proceso de cierre de mes. Synder se centra más en automatizar el flujo de datos de las transacciones diarias.

- Synder frente a Docyt: Docyt utiliza IA para una amplia gama de tareas contables, como el pago de facturas y la gestión de gastos. Synder se centra más en la sincronización automática de datos de ventas y pagos de múltiples canales.

- Synder frente a RefreshMe: RefreshMe es una aplicación de finanzas personales y gestión de tareas. No es un competidor directo, ya que Synder es una herramienta de automatización de la contabilidad empresarial.

- Synder contra Sage: Sage es un sistema de contabilidad integral y de larga trayectoria con funciones avanzadas como la gestión de inventario. Synder es una herramienta especializada que automatiza la entrada de datos en sistemas contables como Sage.

- Synder frente a Zoho Books: Zoho Books es una solución de contabilidad completa. Synder complementa Zoho Books al automatizar el proceso de importación de datos de ventas desde varias plataformas de comercio electrónico.

- Synder contra Wave: Wave es un software de contabilidad gratuito e intuitivo, utilizado frecuentemente por autónomos y pequeñas empresas. Synder es una herramienta de automatización de pago diseñada para empresas con un gran volumen de ventas multicanal.

- Synder frente a Quicken: Quicken es principalmente un software de gestión de finanzas personales, aunque incluye algunas funciones para pequeñas empresas. Synder está diseñado específicamente para la automatización de la contabilidad empresarial.

- Synder contra Hubdoc: Hubdoc es una herramienta de gestión de documentos y captura de datos, similar a Dext. Se centra en la digitalización de facturas y recibos. Synder se centra en la sincronización de datos de ventas y pagos en línea.

- Synder frente a Expensify: Expensify es una herramienta para gestionar informes de gastos y recibos. Synder permite automatizar los datos de las transacciones de venta.

- Synder frente a QuickBooks: QuickBooks es un software de contabilidad integral. Synder Se integra con QuickBooks para automatizar el proceso de introducción de datos de ventas detallados, lo que lo convierte en un complemento valioso en lugar de una alternativa directa.

- Synder frente a AutoEntry: AutoEntry es una herramienta de automatización de entrada de datos que captura información de facturas, recibos y recibos. Synder se centra en la automatización de datos de ventas y pagos desde plataformas de comercio electrónico.

- Synder frente a FreshBooks: FreshBooks es un software de contabilidad diseñado para autónomos y pequeñas empresas de servicios, con especial atención a la facturación. Synder es ideal para empresas con un alto volumen de ventas en múltiples canales online.

- Synder frente a NetSuite: NetSuite es un sistema integral de Planificación de Recursos Empresariales (ERP). Synder es una herramienta especializada que sincroniza datos de comercio electrónico con plataformas más amplias como NetSuite.

Más de Fin de Mes Fácil

A continuación se muestra una breve comparación de Easy Month End con algunas de las principales alternativas.

- Fin de mes fácil vs Puzzle io: Mientras que Puzzle.io está destinado a la contabilidad de empresas emergentes, Easy Month End se centra específicamente en agilizar el proceso de cierre.

- Fin de mes fácil vs. Dext: Dext está destinado principalmente a la captura de documentos y recibos, mientras que Easy Month End es una herramienta integral de gestión de cierre de mes.

- Fin de mes fácil vs. Xero: Xero es una plataforma de contabilidad completa para pequeñas empresas, mientras que Easy Month End proporciona una solución dedicada al proceso de cierre.

- Fin de mes fácil vs. Synder: Synder se especializa en la integración de datos de comercio electrónico, a diferencia de Easy Month End, que es una herramienta de flujo de trabajo para todo el cierre financiero.

- Fin de mes fácil vs. Docyt: Docyt utiliza IA para la contabilidad y la entrada de datos, mientras que Easy Month End automatiza los pasos y tareas del cierre financiero.

- Fin de mes fácil vs. RefreshMe: RefreshMe es una plataforma de asesoramiento financiero, que se diferencia del enfoque de Easy Month End en la gestión cercana.

- Fin de mes fácil vs. Sage: Sage es una suite de gestión empresarial a gran escala, mientras que Easy Month End ofrece una solución más especializada para una función contable crítica.

- Fin de mes fácil vs. Zoho Books: Zoho Books es un software de contabilidad todo en uno, mientras que Easy Month End es una herramienta diseñada específicamente para el proceso de fin de mes.

- Fin de mes fácil vs. ola: Wave ofrece servicios de contabilidad gratuitos para pequeñas empresas, mientras que Easy Month End ofrece una solución más avanzada para la gestión cercana.

- Fin de mes fácil vs. Quicken: Quicken es una herramienta de finanzas personales, lo que hace que Easy Month End sea una mejor opción para las empresas que necesitan administrar el cierre de mes.

- Fin de mes fácil vs. Hubdoc: Hubdoc automatiza la recopilación de documentos, pero Easy Month End está diseñado para administrar todo el flujo de trabajo de cierre y las tareas del equipo.

- Fin de mes fácil vs. Expensify: Expensify es un software de gestión de gastos, que es una función diferente del enfoque principal de Easy Month End en el cierre financiero.

- Fin de mes fácil vs. QuickBooks: QuickBooks es una solución de contabilidad integral, mientras que Easy Month End es una herramienta más específica para gestionar el cierre de mes en sí.

- Fin de mes fácil vs. entrada automática: AutoEntry es una herramienta de captura de datos, mientras que Easy Month End es una plataforma completa para la gestión de tareas y flujo de trabajo durante el cierre.

- Fin de mes fácil vs. FreshBooks: FreshBooks está dirigido a autónomos y pequeñas empresas, mientras que Easy Month End ofrece una solución específica para el cierre de mes.

- Fin de mes fácil vs NetSuite: NetSuite es un sistema ERP completo, con un alcance más amplio que el enfoque especializado de Easy Month End en el cierre financiero.

Preguntas frecuentes

¿Qué hace Synder?

Synder se conecta a tus aplicaciones de ventas y pagos. Organiza toda tu información financiera en un solo lugar dentro de tu sistema de contabilidad. Esto te ayuda a controlar fácilmente tus ingresos y gastos.

¿Es difícil utilizar Easy Month End?

No, Easy Month End está diseñado para ser simple. Utiliza listas de verificación para mostrarte lo que debes hacer al final de cada mes. Esto te ayuda a cerrar tus libros contables sin omitir ningún paso.

¿Puede Synder ayudar con los impuestos?

Sí, Synder puede ayudarte. Se asegura de que tus datos de ventas sean correctos. Esto facilita la declaración de impuestos, ya que tus registros son más precisos.

¿Quién debería utilizar Synder?

Si vendes cosas en línea y usas diferentes aplicaciones para pagar, Synder puede ahorrarte mucho tiempo. También es bueno para... contadores que trabajan con muchos clientes.

¿Qué programa es mejor para el propietario de una pequeña empresa?

Ambos programas pueden ayudar. Synder es excelente para gestionar las ventas y el dinero diarios. Easy Month End es ideal para organizar el cierre de mes. Depende de qué área de tu negocio necesites más ayuda en este momento.