Sind Sie unsicher bei der Auswahl des Richtigen? Buchhaltungssoftware für Ihr Unternehmen?

Das kann schwierig sein!

Sowohl Xero als auch NetSuite sind beliebte Optionen, aber sie unterscheiden sich deutlich.

Stellen Sie sich vor, Sie wählen die falsche Software und haben dann Kopfschmerzen bei der Geldverwaltung. später.

Dieser Artikel erklärt die Unterschiede zwischen Xero und NetSuite auf einfache Weise.

Überblick

Die richtige Wahl treffen Buchhaltung Die Wahl der Software ist eine sehr wichtige Entscheidung.

Um Ihnen zu helfen, haben wir uns Xero und NetSuite genauer angesehen.

Unser Team hat ihre wichtigsten Merkmale und ihre Funktionsweise in verschiedenen Umgebungen untersucht. Geschäft Szenarien, um Ihnen einen klaren Vergleich zu ermöglichen.

Schließen Sie sich über 2 Millionen Unternehmen an, die die cloudbasierte Buchhaltungssoftware Xero nutzen. Entdecken Sie jetzt die leistungsstarken Rechnungsstellungsfunktionen!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das kostenpflichtige Abonnement beginnt bei 29 $/Monat.

Hauptmerkmale:

- Bankabstimmung

- Fakturierung

- Berichterstattung

Steigern Sie Ihre Produktivität um bis zu 78 %! Erfahren Sie, wie die Automatisierungstools von NetSuite Ihren Arbeitsalltag verändern können. Entdecken Sie mehr!

Preisgestaltung: Es gibt eine kostenlose Testphase. Individuelle Preispläne sind verfügbar.

Hauptmerkmale:

- ERP-Integration

- CRM

- Erweiterte Analytik

Was ist Xero?

Sie interessieren sich also für Xero? Es ist beliebt.

Betrachten Sie es als Ihre Online-Zentrale für alles rund ums Geld.

Es hilft kleinen und mittelständischen Unternehmen, ihre Finanzen unkompliziert im Blick zu behalten.

Entdecken Sie auch unsere Favoriten Xero-Alternativen…

Unsere Einschätzung

Schließen Sie sich über 2 Millionen Unternehmen an Xero verwenden Buchhaltungssoftware. Entdecken Sie jetzt die leistungsstarken Rechnungsstellungsfunktionen!

Wichtigste Vorteile

- Automatisierter Bankabgleich

- Online-Rechnungsstellung und Zahlungen

- Rechnungsverwaltung

- Integration der Gehaltsabrechnung

- Berichterstattung und Analysen

Preisgestaltung

- Anlasser: 29 US-Dollar pro Monat.

- Standard: 46 US-Dollar pro Monat.

- Prämie: 69 US-Dollar pro Monat.

Vorteile

Nachteile

Was ist NetSuite?

Nun lasst uns über NetSuite sprechen.

Betrachten Sie es als den großen Bruder im Buchhaltung Softwarewelt.

Es ist mehr als nur BuchhaltungEs handelt sich um ein vollwertiges Enterprise Resource Planning (ERP)-System.

Entdecken Sie auch unsere Favoriten NetSuite-Alternativen…

Unsere Einschätzung

Sie benötigen die Leistungsfähigkeit einer Enterprise-Lösung? NetSuite betreut weltweit über 30.000 Kunden mit seiner umfassenden Plattform. Wenn Sie eine vollständige ERP-Integration und fortschrittliche Analysen benötigen, ist NetSuite die richtige Wahl für Ihr Wachstum.

Wichtigste Vorteile

- Es vereint die Finanzwelt, CRMund ERP in einem einzigen Cloud-System.

- Es unterstützt Unternehmen in über 200 Ländern und 27 Sprachen.

- Über 40.000 Organisationen nutzen diese skalierbare Plattform.

- Sie erhalten integrierte Analysefunktionen für Echtzeit-Einblicke in Ihre Daten.

Preisgestaltung

Sie bieten maßgeschneiderte Preispläne an, die auf Ihre Bedürfnisse zugeschnitten sind. Kontaktieren Sie sie, um Ihr optimales Preisangebot zu erhalten.

Vorteile

Nachteile

Funktionsvergleich

Es ist an der Zeit, sich mit den Details auseinanderzusetzen.

Beide Plattformen haben viel zu bieten, aber ihre Stärken liegen in ganz unterschiedlichen Bereichen.

Hier finden Sie eine detaillierte Aufschlüsselung der einzelnen Funktionen und ihrer jeweiligen Vorteile.

1. Finanzmanagement

- Xero: Xero Buchhaltung Die Software wurde für Unternehmen entwickelt, um deren zentrale Finanzaufgaben problemlos zu bewältigen. Es umfasst Funktionen für Kreditorenbuchhaltung, Debitorenbuchhaltung und Online-Rechnungsstellung.

- NetSuite: Als cloudbasiertes ERP-System bietet Oracle NetSuite einen vollständig integrierten Ansatz für das Finanzmanagement. Es umfasst ein vollständiges Hauptbuch, eine fortschrittliche Kreditorenbuchhaltung und ein vollständig integriertes System zur Erfassung von Ausgaben und Einnahmen.

2. Automatisierung und Dateneingabe

- Xero: Xero vereinfacht die Arbeit durch automatische Bankfeeds, die Banktransaktionen direkt importieren. So können Kleinunternehmer die manuelle Dateneingabe reduzieren und die Finanzbuchhaltung unkompliziert verwalten.

- NetSuite: Oracle NetSuite automatisiert ebenfalls Prozesse. Es kann alles automatisieren, von Lieferantenrechnungen bis hin zur komplexen Umsatzrealisierung, und bietet fortschrittliche Automatisierungsfunktionen, die weit über die grundlegenden Funktionen hinausgehen. Buchhaltung.

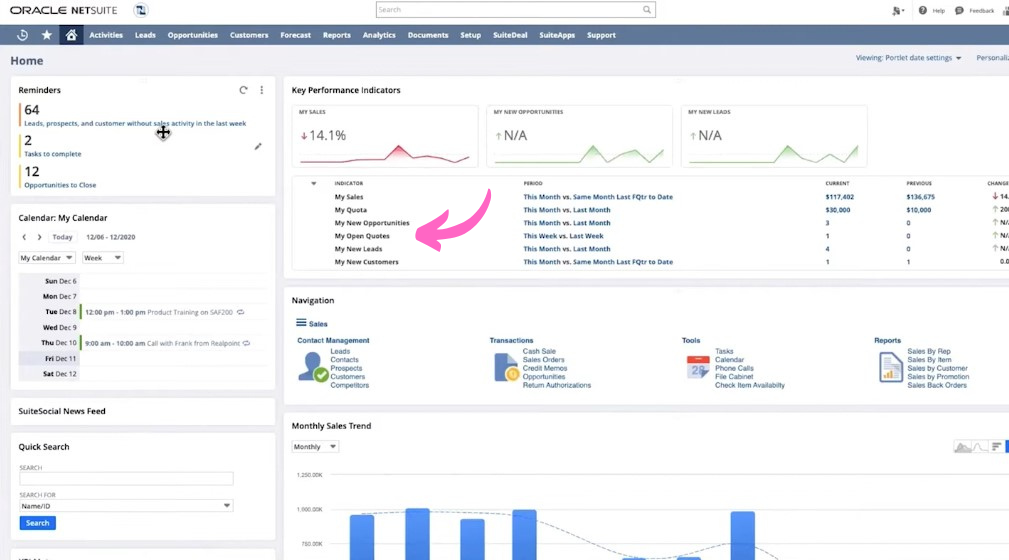

3. Berichterstellung und Dashboards

- Xero: Das Xero-Dashboard bietet einen schnellen Überblick über die finanzielle Lage Ihres Unternehmens. Berichterstattung Die Funktionen sind übersichtlich und einfach zu bedienen und liefern Standardberichte zur Finanzlage und zum Cashflow.

- NetSuite: NetSuite-Nutzer erhalten leistungsstarke, individuell anpassbare Berichte mit Echtzeitdaten. Sie können Dashboards mit benutzerdefinierten Leistungskennzahlen erstellen, um einen vollständigen Überblick über Ihr Unternehmen zu erhalten, was für etablierte Unternehmen unerlässlich ist.

4. Bestandsmanagement

- Xero: Mit Xero können Sie Ihren Lagerbestand mithilfe grundlegender Tracking-Funktionen verwalten. Es eignet sich gut für kleine Unternehmen mit einfachen Lagerhaltungsanforderungen, aber ohne fortgeschrittene Funktionen für komplexe Vorgänge.

- NetSuite: NetSuite bietet leistungsstarke Bestandsverwaltungstools für Unternehmen. Dazu gehören Funktionen wie Lagerverwaltung, Standortverfolgung und Bedarfsplanung.

5. Mobile Zugänglichkeit

- Xero: Die mobile App von Xero ist hoch bewertet und funktioniert einwandfrei auf beiden Geräten. iOS und Android-Geräte. Für Kleinunternehmer ist es ideal, um Aufgaben unterwegs zu erledigen.

- NetSuite: Die NetSuite-Mobil-App bietet Zugriff auf eine Vielzahl von Funktionen. Sie ermöglicht es Benutzern, Finanzdaten einzusehen, Transaktionen zu genehmigen und Dashboards von überall aus zu überprüfen.

6. Ausgaben und Gehaltsabrechnung

- Xero: Xero bietet einen Einsteigerplan an, mit dem Sie Ausgaben erfassen und eine begrenzte Anzahl offener Rechnungen verwalten können. Sie können außerdem Rechnungen und Belege erfassen.

- NetSuite: NetSuite verfügt über Module für Spesenabrechnungen und Gehaltsabrechnung. Es bietet fortschrittliche Funktionen wie Personalmanagement und Workforce-Management, um all Ihre HR-Anforderungen abzudecken.

7. Skalierbarkeit

- Xero: Xero eignet sich zwar hervorragend für Startups, doch manche expandierende Unternehmen stoßen mit der Zeit an seine Grenzen. Der Wechsel von Xero zu NetSuite ist ein gängiger Schritt, sobald ein Unternehmen größer wird.

- NetSuite: NetSuite ERP ist so konzipiert, dass es mit Ihrem Unternehmen mitwächst. Es unterstützt große Unternehmen mit mehreren Standorten und verschiedenen Währungen und ermöglicht so ein reibungsloses Geschäftswachstum.

8. Integrationen

- Xero: Xero zeichnet sich durch seine vielfältigen App-Integrationen aus. Es verbindet sich mit anderen Systemen und Softwarelösungen und bietet Ihnen so ein umfassendes Komplettpaket.

- NetSuite: Oracle NetSuite bietet eine vollständig integrierte Suite, die den Bedarf an vielen anderen Systemen reduziert. Sie bietet individuelle Integrationen und legt großen Wert auf nahtlose, integrierte Funktionalität.

9. Preise und Tarife

- Xero: Die Kosten für Xero sind transparent und erschwinglich. Der Standardtarif ermöglicht die Erstellung unbegrenzter Rechnungen und Belege.

- NetSuite: Die Preisgestaltung von NetSuite ist stark individualisiert und richtet sich nach der Größe und den Bedürfnissen Ihres Unternehmens. Es ist deutlich teurer, bietet aber fortschrittliche Funktionen wie Projektverfolgung und andere leistungsstarke Geschäftslösungen.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

Hier ist eine kurze Checkliste mit wichtigen Erkenntnissen und Unterscheidungsmerkmalen, die Ihnen bei Ihrer Entscheidung helfen soll:

- Komplexität vs. Einfachheit: Benötigen Sie eine einfache, cloudbasierte Buchhaltungssoftware wie Xero oder ein komplettes Enterprise-Resource-Planning-System wie NetSuite?

- ERP-Anforderungen: Bei umfangreichen Anforderungen sollten Sie prüfen, ob die Software Supply-Chain-Management, Auftragsmanagement, Kundenbeziehungsmanagement oder die Automatisierung von professionellen Dienstleistungen bietet.

- Prüfung und Sicherheit: Prüfen Sie, ob das System Prüfprotokolle und Funktionen zur Verbesserung der Prüfprotokolle für genaue Finanzberichte enthält.

- Globale Geschäftstätigkeit: Wenn Sie international tätig sind, achten Sie auf globale Buchhaltungsfunktionen und die Unterstützung mehrerer Währungen.

- Skalierbarkeit: Prüfen Sie, ob die Plattform Geschäftsbereiche verwalten kann, die Datenmigration unterstützt und für wachsende Unternehmen empfohlen wird.

- Ökosystem und Integration: Beurteilen Sie den Wert einer nahtlosen Integration (wie bei den anderen Modulen von NetSuite) im Vergleich zur Flexibilität des Xero Marketplace.

- Fokus auf Cashflow: Setzen Sie vorrangig auf Tools mit starkem Cashflow-Management, Bankabstimmungen und der Möglichkeit, Bankkonten zu verfolgen und Zahlungen zu planen.

- Finanzielle Transparenz: Stellen Sie sicher, dass die Software detaillierte Daten zur finanziellen Leistungsfähigkeit und Echtzeit-Einblicke in die Finanzen Ihres Unternehmens liefert.

- Unterstützung und Ressourcen: Schauen Sie sich die angebotene Unterstützung, die Online-Ressourcen und den Community-Zugang (Xero Central) an. Um die Kundenzufriedenheit einzuschätzen, lesen Sie Rezensionen zu NetSuite und zur Buchhaltungssoftware Xero.

- Passform für den Benutzer: Decide if you want the best accounting software for independent contractors or a comprehensive suite for established businesses managed by Oracle Corporation.

Endgültiges Urteil

Bei der Auswahl müssen wir Ihre Größe berücksichtigen.

Wir empfehlen Xero, wenn Sie eine übersichtliche, benutzerfreundliche Oberfläche und eine leistungsstarke, cloudbasierte Buchhaltungssoftware benötigen.

Xero bietet günstige Preise und eignet sich hervorragend zur Verwaltung von Ausgaben und bis zu fünf Rechnungen.

Mit Xero können Sie Ihre wichtigsten Finanzprozesse verwalten und aussagekräftige Finanzberichte erstellen.

Für große E-Commerce-Unternehmen oder schnell wachsende Firmen, die detaillierte Bestandsdaten und eine vollständig integrierte Unternehmensmanagement-Software benötigen, empfehlen wir jedoch NetSuite.

Es bietet umfassende Buchhaltungsfunktionen, verwaltet Anlagevermögen und trägt zur Steigerung der Gesamtleistung des Unternehmens bei.

Unser detaillierter Vergleich hilft Ihnen bei der Entscheidung, welches Produkt am besten zu Ihren Geschäftsprozessen passt.

Mehr von Xero

Die Wahl der richtigen Buchhaltungssoftware erfordert die Prüfung einer Reihe von Optionen.

Hier ein kurzer Vergleich von Xero mit anderen gängigen Produkten.

- Xero vs. QuickBooks: QuickBooks ist ein wichtiger Konkurrent. Beide bieten zwar ähnliche Kernfunktionen, Xero wird jedoch häufig für seine übersichtliche Benutzeroberfläche und die unbegrenzte Benutzeranzahl gelobt. QuickBooks kann komplexer sein, bietet aber sehr leistungsstarke Berichtsfunktionen.

- Xero vs FreshBooks: FreshBooks ist besonders bei Freiberuflern und Dienstleistungsunternehmen beliebt. Es eignet sich hervorragend für Rechnungsstellung und Zeiterfassung. Xero bietet eine umfassendere Buchhaltungslösung.

- Xero vs. Sage: Sowohl Sage als auch Xero bieten Lösungen für kleine Unternehmen an. Sage bietet jedoch auch umfassendere ERP-Systeme (Enterprise Resource Planning) für größere Unternehmen.

- Xero vs Zoho Books: Zoho Books ist Teil einer umfangreichen Suite von Business-Anwendungen. Es bietet oft erweiterte Funktionen für die Lagerverwaltung und ist sehr kostengünstig. Xero hingegen ist eine führende Option, die sich durch Einfachheit und Benutzerfreundlichkeit auszeichnet.

- Xero vs Wave: Wave ist für seinen kostenlosen Tarif bekannt. Er eignet sich hervorragend für Kleinstunternehmen oder Freiberufler mit begrenztem Budget. Xero bietet einen größeren Funktionsumfang und ist besser für Unternehmenswachstum geeignet.

- Xero vs. Quicken: Quicken ist hauptsächlich für die private Finanzverwaltung gedacht. Zwar bietet es einige Funktionen für Unternehmen, ist aber keine vollwertige Buchhaltungslösung. Xero hingegen wurde speziell für die komplexen Anforderungen der betrieblichen Buchhaltung entwickelt.

- Xero vs HubdocEs handelt sich hierbei nicht um direkte Konkurrenten. Sowohl Dext als auch Hubdoc sind Tools, die die Dokumentenerfassung und Dateneingabe automatisieren. Sie sind direkt in Xero integriert, um die Buchhaltung schneller und genauer zu gestalten.

- Xero vs Synder: Synder ist eine Plattform, die Vertriebskanäle und Zahlungsanbieter mit Buchhaltungssoftware verbindet. Sie hilft dabei, die Dateneingabe von Plattformen wie Shopify und Stripe direkt in Xero zu automatisieren.

- Xero vs ExpensifyExpensify konzentriert sich speziell auf das Spesenmanagement. Xero bietet zwar auch Spesenfunktionen, Expensify bietet jedoch fortschrittlichere Tools für die Verwaltung von Mitarbeiterausgaben und -erstattungen.

- Xero vs. Netsuite: NetSuite ist ein umfassendes ERP-System für große Unternehmen. Es bietet eine komplette Palette an Tools für das Unternehmensmanagement. Xero ist kein ERP-System, aber eine hervorragende Buchhaltungslösung für kleine Unternehmen.

- Xero vs Puzzle IO: Puzzle IO ist eine Finanzplattform für Startups, die sich auf Finanzberichte in Echtzeit und automatisierte Dateneingabe konzentriert.

- Xero vs. Easy Monatsabschluss: Diese Software ist ein Spezialwerkzeug zur Automatisierung des Monatsabschlusses und unterstützt die Abstimmung und die Nachverfolgung von Konten. Sie ist für die Zusammenarbeit mit Xero konzipiert, nicht als Ersatz.

- Xero vs Docyt: Docyt nutzt KI, um Backoffice- und Buchhaltungsaufgaben zu automatisieren. Es bietet die Möglichkeit, alle Ihre Finanzdokumente und -daten an einem Ort einzusehen.

- Xero vs RefreshMe: RefreshMe ist eine einfachere Buchhaltungssoftware mit Basisfunktionen, die häufig für private Finanzen oder sehr kleine Unternehmen verwendet wird.

- Xero vs AutoEntry: Ähnlich wie Dext und Hubdoc ist AutoEntry ein Tool, das die Datenextraktion aus Belegen und Rechnungen automatisiert und für die Integration und Erweiterung von Buchhaltungssoftware wie Xero entwickelt wurde.

Mehr von NetSuite

- NetSuite vs PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- NetSuite vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- NetSuite vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- NetSuite vs. SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- NetSuite vs. Easy Month EndDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- NetSuite vs. DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- NetSuite vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- NetSuite vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- NetSuite vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- NetSuite vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- NetSuite vs. HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- NetSuite vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- NetSuite vs. QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- NetSuite vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

Häufig gestellte Fragen

Is Xero suitable for small businesses?

Ja, Xero eignet sich aufgrund seines benutzerfreundlichen Dashboards und seiner erschwinglichen Preispläne im Allgemeinen hervorragend für kleine Unternehmen.

Warum sind die Preise von NetSuite höher als die von Xero?

NetSuite bietet eine umfassende Palette an Funktionen, die über die grundlegende Buchhaltung hinausgehen, darunter CRM und Bestandsmanagement, was die höheren Kosten rechtfertigt.

Kann ich später von Xero zu NetSuite wechseln?

Ja, viele Unternehmen beginnen mit Xero und wechseln dann zu NetSuite, wenn ihre Anforderungen komplexer werden und sie mehr Funktionen benötigen.

Was sind die Hauptunterschiede zwischen NetSuite und Xero?

Xero konzentriert sich auf unkomplizierte Buchhaltung für kleinere Unternehmen, während NetSuite ein vollständiges ERP-System für größere, komplexere Organisationen ist.

Welche Buchhaltungslösung eignet sich besser für ein wachsendes Unternehmen?

Beide Systeme unterstützen Wachstum, aber NetSuite ist auf hohe Skalierbarkeit ausgelegt und bietet erweiterte Funktionen für größere, expandierende Unternehmen.