Möchten Sie Ihre Geschäftsfinanzen stressfrei im Blick behalten?

Das kann ganz schön schwierig sein, nicht wahr?

But which one is actually better for Du?

Wir werden Synder und Wave vergleichen, ihre jeweiligen Funktionen erklären und Ihnen bei der Entscheidung helfen, welches Programm das richtige für Sie ist. Buchhaltungssoftware könnte der Gewinner für Ihr Unternehmen sein.

Los geht's!

Überblick

Wir haben uns sowohl Synder als auch Wave genauer angesehen.

Wir haben sie ausprobiert, um zu sehen, wie sie funktionieren.

This helped us compare them fairly.

Nun können wir Ihnen zeigen, was wir gefunden haben.

Das wird Ihnen helfen, das beste Produkt auszuwählen.

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

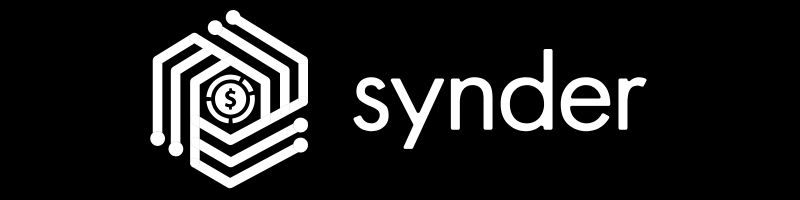

Preisgestaltung: It has a free trial. The premium plan starts at $52/month.

Hauptmerkmale:

- Multi-Channel Sales Sync

- Automatisierter Abgleich

- Detaillierte Berichterstattung

Über 4 Millionen kleine Unternehmen Vertrauen Sie Wave die Verwaltung Ihrer Finanzen an. Entdecken Sie die Angebote von Wave und finden Sie das passende für sich.

Preisgestaltung: Kostenloser Tarif verfügbar. Der kostenpflichtige Tarif beginnt bei 19 $/Monat.

Hauptmerkmale:

- Fakturierung

- Bankwesen

- Lohnabrechnungs-Add-on.

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different business apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Entdecken Sie auch unsere Favoriten Synder Alternatives…

Unsere Einschätzung

Synder automatisiert Ihre Buchhaltung und synchronisiert Verkaufsdaten nahtlos mit QuickBooks. Xeround vieles mehr. Unternehmen, die Synder nutzen, berichten von einer durchschnittlichen Zeitersparnis von über 10 Stunden pro Woche.

Wichtigste Vorteile

- Automatische Synchronisierung von Verkaufsdaten

- Multi-Channel-Vertriebsverfolgung

- Zahlungsabstimmung

- Integration der Bestandsverwaltung

- Detaillierte Verkaufsberichte

Preisgestaltung

Alle Pläne werden Jährliche Abrechnung.

- Basic: 52 US-Dollar pro Monat.

- Essentiell: 92 US-Dollar pro Monat.

- Pro: 220 US-Dollar pro Monat.

- Prämie: Individuelle Preisgestaltung.

Vorteile

Nachteile

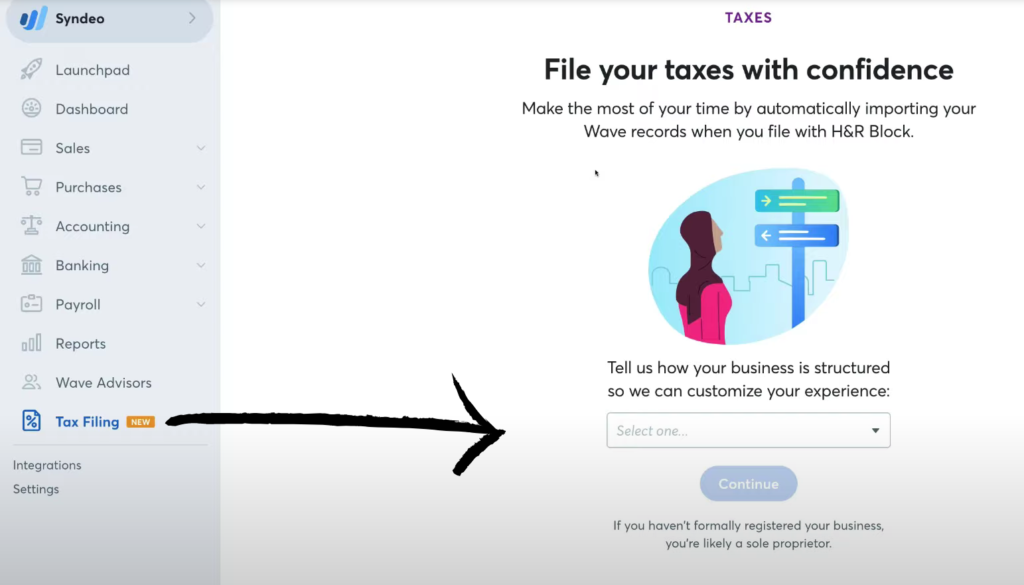

Was ist eine Welle?

Okay, reden wir über Wave.

Betrachten Sie es als einen hilfsbereiten Freund für Ihre Geschäftsfinanzen.

Es ermöglicht Ihnen beispielsweise das Versenden von Rechnungen und die Nachverfolgung von Einnahmen und Ausgaben.

Es kann Ihnen helfen, sich einen umfassenden Überblick über Ihre Unternehmensfinanzen zu verschaffen.

Entdecken Sie auch unsere Favoriten Wellenalternativen…

Unsere Einschätzung

Geben Sie sich nicht mit weniger zufrieden! Schließen Sie sich den über 2 Millionen Kleinunternehmen an, die auf die leistungsstarken, kostenlosen Buchhaltungsfunktionen von Wave setzen, um ihre Finanzen noch heute zu optimieren.

Wichtigste Vorteile

Zu den Stärken von Wave gehören:

- Ein 100% kostenloser Basis-Buchhaltungsplan.

- Wir betreuen über 2 Millionen Kleinunternehmen.

- Einfache Rechnungserstellung und Zahlungsabwicklung.

- Keine langfristigen Verträge oder Garantien.

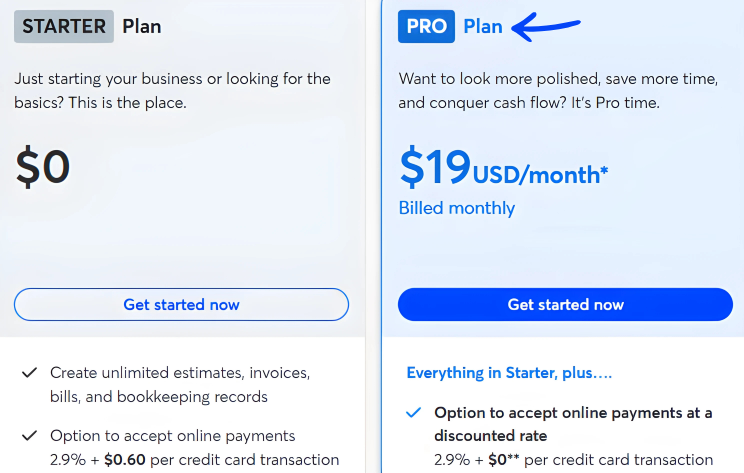

Preisgestaltung

- Starterplan: 0 € pro Monat.

- Pro-Plan: 19 Dollar pro Monat.

Vorteile

Nachteile

Funktionsvergleich

Die richtige Wahl treffen Buchhaltung Ein System kann sich wie eine große Sache anfühlen.

Werfen wir einen Blick auf neun Schlüsselfunktionen, um herauszufinden, welche Plattform – Synder oder Wave – am besten für Ihr kleines Unternehmen geeignet ist. Buchhaltung.

1. Synchronisierung und Automatisierung

- Synder ist für die Automatisierung konzipiert. Es kann ein hohes Volumen an historischen Transaktionen verarbeiten.

- Es importiert Transaktionen automatisch. Das hilft, Ihre Buchhaltung auszugleichen und nimmt Ihnen den Stress. Buchhaltung.

- Mit einem einzigen Synchronisierungsmodus und einer Ein-Klick-Einrichtung können Sie Ihre Bücher auf den neuesten Stand bringen.

- Wave bietet auch die Möglichkeit, Banktransaktionen automatisch zu importieren, aber die automatisierte Buchhaltung von Synder ist bei hohen Transaktionsvolumina besser geeignet.

2. Mehrkanalunterstützung

- Synder eignet sich hervorragend für den E-Commerce. Es hilft bei der Verwaltung all Ihrer Vertriebskanäle wie Shopify, Etsy und eBay.

- Es erfasst alle Details Ihrer Verkäufe, einschließlich Rückerstattungen, Gebühren, Versandkosten und Rabatte. Dies hilft Ihnen, etwaige Probleme zu lösen.

- Wave konzentriert sich stärker auf Unternehmen mit einem einzigen Geschäft oder einer einzigen Dienstleistung.

3. Integrations

- Synder ist mit führenden Anbietern von Buchhaltungssystemen wie QuickBooks Online und Xero bestens kompatibel. Salbei Intacct und NetSuite.

- Es ist außerdem mit vielen Zahlungsanbietern wie Stripe, PayPal, Square und Clover kompatibel.

- Wave integriert eigene Tools für Zahlungen und Gehaltsabrechnung, jedoch nicht so viele externe Dienste.

4. Umsatzverfolgung

- Die Umsatzrealisierungsfunktion von Snyder ist eine große Hilfe für Finanzteams.

- Es kann Ihre Abonnements und Umsätze im Hintergrund verfolgen. Dies trägt zur Einhaltung der Rechnungslegungsgrundsätze bei.

- Es erstellt präzise Bilanzen und liefert klare Erkenntnisse.

- Die Werkzeuge von Wave hierfür sind nicht so fortschrittlich.

5. Preise und Tarife

- Wave is known for its free Buchhaltungssoftware. It offers a free starter plan and a paid pro plan.

- Die kostenlose Version bietet unbegrenzte Rechnungsstellung und hilft Kleinunternehmern, ihre Ausgaben zu verfolgen.

- Synder bietet verschiedene Abonnementstufen mit einem kostenpflichtigen Tarif an, der sich möglicherweise besser für Unternehmen mit einem hohen Transaktionsvolumen eignet.

6. Rechnungsstellung und Zahlungen

- Beide Plattformen ermöglichen die Erstellung von Rechnungen. Die Rechnungsfunktionen von Wave und die unbegrenzte Anzahl an Rechnungen sind für viele Nutzer ein besonderes Highlight.

- Wave ermöglicht auch die Annahme von Online-Zahlungen. Es bietet automatische Zahlungserinnerungen.

- Synder bietet außerdem hervorragende Tools für die Rechnungsstellung bei Online-Zahlungen.

7. Lohn- und Gehaltsabrechnung

- Wave Payroll ist eine im Preis enthaltene Funktion. Sie ermöglicht die Bezahlung Ihrer freien Mitarbeiter oder Angestellten per Direktüberweisung.

- Synder verfügt über kein integriertes Lohnabrechnungstool.

8. Benutzerzugriff

- Wave ermöglicht die Nutzung durch mehrere Personen im Rahmen eines kostenpflichtigen Abonnements.

- Synder ermöglicht das Hinzufügen von Buchhaltern und anderen Benutzern, was für mehrere Unternehmen und verschiedene Finanzteams von Vorteil ist.

9. Belegscannen

- Wave bietet eine hervorragende Funktion zum Scannen von Belegen. Dies erleichtert die Ausgabenverfolgung.

- Man kann ein Foto von einem Kassenbon machen und es wird zu einem Buchhaltung aufzeichnen.

- Synder verfügt nicht über ein vergleichbares Tool.

Worauf sollte man bei der Auswahl einer Buchhaltungssoftware achten?

- Kosten und WertPrüfen Sie, ob eine kostenlose Plattform wie Wave Financial ausreicht oder ob ein kostenpflichtiges Abo bessere Funktionen bietet. Achten Sie auf zusätzliche Kosten, beispielsweise Gebühren für bestimmte Kreditkarten oder Bankzahlungen. Sie möchten schließlich eine gute Rendite für Ihr Geld.

- Kernfunktionen der Buchhaltung: Machen Die Buchhaltungsfunktionen sind sicherlich leistungsstark. Dazu gehören ein gutes Hauptbuch, die Möglichkeit, Ihre Bankkonten zu verfolgen, und eine ordnungsgemäße Abstimmung, um Fehler zu vermeiden.

- Rechnungsstellung und ZahlungenPrüfen Sie die Rechnungssoftware. Unterstützt sie wiederkehrende Rechnungen und Zahlungen? Können Sie Online-Zahlungen akzeptieren, einschließlich Kreditkartenzahlungen und Apple Pay? Dies ist entscheidend für einen guten Cashflow.

- ProzessautomatisierungDie Software sollte Ihnen helfen, Transaktionen schnell zu verarbeiten. Achten Sie auf Tools mit automatischer Zusammenführungsfunktion. Daten und erspart Ihnen die manuelle Dateneingabe. Dadurch entfällt der Stress, alles selbst einreichen zu müssen.

- Vertrieb und KanäleWenn Sie an verschiedenen Orten verkaufen, achten Sie auf Unterstützung für den Multi-Channel-Vertrieb. Synder eignet sich dafür hervorragend. Wichtig ist, dass all Ihre Daten synchronisiert werden, damit Sie einen vollständigen Überblick über Ihre Auszahlungen haben.

- Lohnbuchhaltung und AuftragnehmerWenn Sie Mitarbeiter haben, ist eine Lohnabrechnung erforderlich. In Rezensionen zu Wave Accounting werden häufig die Buchhaltungs- und Lohnabrechnungstools hervorgehoben. Prüfen Sie, ob das System die Fälligkeit von Zahlungen an freiberufliche Mitarbeiter problemlos handhabt.

- BerichterstattungSie benötigen übersichtliche Finanzberichte. Dies ist für die Steuererklärung unerlässlich. Das System sollte Ihnen helfen, Ihre Finanzverwaltungsfunktionen zu verstehen.

- Benutzer und SicherheitKönnen Sie eine unbegrenzte Nutzerzahl haben und sich trotzdem sicher fühlen? Achten Sie auf Multi-Faktor-Authentifizierung und einen starken Schutz Ihrer sensiblen Daten. Die mobile App sollte außerdem sicher und benutzerfreundlich sein.

- Fortgeschrittene BedürfnisseWenn Sie mit internationalen Kunden arbeiten, achten Sie auf Funktionen für mehrere Währungen. Wenn Sie nach Zeitaufwand abrechnen, stellen Sie sicher, dass die Software die abrechnungsfähigen Stunden erfassen kann. Letztendlich sollte die Software Ihren tatsächlichen Geschäftsanforderungen entsprechen.

- UnterstützungAchten Sie auf ein zuverlässiges Hilfecenter und ein System, das Ihnen Sicherheit gibt. Unternehmen wie Wave bieten zwei Tarife an; prüfen Sie daher den Support für jeden Tarif. Wir empfehlen Wave für einfache Buchhaltung und Rechnungsstellung.

Endgültiges Urteil

Nach eingehender Prüfung aller Funktionen können wir mit Freude sagen, dass Synder unsere erste Wahl für viele Online-Händler ist.

Der Wave-Test zeigt, dass es sich um eine großartige, kostenlose Buchhaltungssoftware für kleine Unternehmen mit grundlegenden Anforderungen handelt.

Mit Wave lässt sich die Rechnungsstellung ganz einfach einrichten.

Wenn Ihr Unternehmen jedoch viele Kreditkartentransaktionen abwickelt und eine detaillierte Zahlungsabwicklung benötigt, ist Synder besser geeignet.

Die fortschrittlichen Funktionen sind es wert.

Wir haben alle Fakten sorgfältig geprüft, damit Sie unbesorgt wechseln können.

Das hilft Ihnen bei der Bestandsverwaltung und sorgt für korrekte Buchhaltung, sodass Sie beruhigt sein können.

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Snyder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Snyder ergänzt Zoho Books durch die Automatisierung des Imports von Verkaufsdaten von verschiedenen E-Commerce-Plattformen.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks ist eine umfassende Buchhaltungssoftware. Snyder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

Mehr von Wave

- Wave vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Wave vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Wave vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Wave vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Wellen vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Wave vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Wave vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Wave vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Wave vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- Wave vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Welle vs. AusgabenDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Wave vs. QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Wave vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Wave vs. FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Wave vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Was ist der Hauptunterschied zwischen Synder und Wave?

Synder eignet sich hervorragend zur Vernetzung vieler Vertriebsstandorte. Wave ist stark für grundlegende Buchhaltung und Rechnungsstellung. Wenn Sie über viele Vertriebskanäle verkaufen, ist Synder möglicherweise die bessere Wahl.

Ist Wave Accounting völlig kostenlos?

Wave bietet einen kostenlosen Tarif an. Damit können Sie Rechnungen erstellen und Ihre Finanzen im Blick behalten. Für zusätzliche Funktionen wie die Lohnabrechnung ist jedoch eine zusätzliche Gebühr erforderlich.

Kann Synder eine Verbindung zu meinen Online-Shops herstellen?

Ja, Synder kann mit vielen Online-Shops und Zahlungssystemen verbunden werden. Es hilft Ihnen, alle Ihre Verkäufe an einem Ort einzusehen, ohne dass Sie dies selbst tun müssen.

Welche Software ist für jemanden, der neu im Rechnungswesen ist, einfacher zu bedienen?

Wave gilt oft als einsteigerfreundlicher. Es hat ein einfaches Design. Synder bietet mehr Funktionen und wirkt daher anfangs möglicherweise etwas komplizierter.

Muss ich ein großes Unternehmen sein, um Synder oder Wave nutzen zu können?

Nein, sowohl Synder als auch Wave eignen sich für kleine Unternehmen. Sie helfen Ihnen, Ihre Finanzen zu organisieren, unabhängig von der aktuellen Größe Ihres Unternehmens.