Versuchen Sie herauszufinden, welches Buchhaltungssoftware Was ist das Beste für Ihr Unternehmen?

Bei so vielen Auswahlmöglichkeiten kann das ganz schön schwierig sein!

Puzzle IO und FreshBooks sind zwei beliebte Optionen.

Aber welches sollten Sie wählen?

In diesem Artikel werden wir Puzzle IO und FreshBooks detailliert vergleichen, um Ihnen bei der Entscheidung zu helfen, welches System am besten zu Ihnen passt.

Überblick

Wir haben viel Zeit damit verbracht, Puzzle IO und FreshBooks ausgiebig zu erkunden und zu testen.

Unsere praktischen Erfahrungen im Umgang mit ihren Funktionen und Features.

Als Grundlage dieses detaillierten Vergleichs soll sichergestellt werden, dass Sie ein praktisches Verständnis davon erhalten, was jede Plattform bietet.

Bereit, Ihre Finanzen zu vereinfachen? Entdecken Sie, wie Puzzle IO Ihnen bis zu 20 Stunden im Monat sparen kann. Erleben Sie den Unterschied.

Preisgestaltung: Kostenloser Tarif verfügbar. Der kostenpflichtige Tarif beginnt bei 42,50 $/Monat.

Hauptmerkmale:

- Finanzplanung

- Prognose

- Echtzeitanalyse

Bereit für einfachere Rechnungsstellung und schnellere Bezahlung? Über 30 Millionen Menschen nutzen bereits FreshBooks. Entdecken Sie es jetzt!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das kostenpflichtige Abonnement beginnt bei 2,10 $/Monat.

Hauptmerkmale:

- Zeiterfassung

- Fakturierung

- Buchhaltung

Was ist Puzzle IO?

Also, Puzzle IO, hm? Es ist Buchhaltung Software.

Es scheint ziemlich projektorientiert zu sein.

Es gibt viele Tools, um sie zu verwalten.

Entdecken Sie auch unsere Favoriten Puzzle IO-Alternativen…

Unsere Einschätzung

Bereit, Ihre Finanzen zu vereinfachen? Entdecken Sie, wie Puzzle io Ihnen bis zu 20 Stunden im Monat sparen kann. Erleben Sie den Unterschied noch heute!

Wichtigste Vorteile

Puzzle IO glänzt besonders dann, wenn es darum geht, Ihnen zu helfen, zu verstehen, wohin sich Ihr Unternehmen entwickelt.

- 92 % Nutzer berichten von einer höheren Genauigkeit der Finanzprognosen.

- Erhalten Sie Echtzeit-Einblicke in Ihren Cashflow.

- Erstellen Sie unkompliziert verschiedene Finanzszenarien für Ihre Planung.

- Arbeiten Sie nahtlos mit Ihrem Team an Ihren finanziellen Zielen zusammen.

- Wichtige Leistungsindikatoren (KPIs) an einem Ort verfolgen.

Preisgestaltung

- Grundlagen der Buchhaltung: 0 €/Monat.

- Einblicke in Accounting Plus: 42,50 $/Monat.

- Accounting Plus Advanced Automation: 85 US-Dollar pro Monat.

- Accounting Plus-Skala: 255 US-Dollar pro Monat.

Vorteile

Nachteile

Was ist FreshBooks?

Okay, reden wir über FreshBooks.

Es Buchhaltung Auch Software. Aber es scheint eher auf dienstleistungsorientierte Unternehmen ausgerichtet zu sein.

Denken Freiberufler und Berater.

Entdecken Sie auch unsere Favoriten FreshBooks-Alternativen…

Unsere Einschätzung

Sie haben genug von komplizierter Buchhaltung? Über 30 Millionen Unternehmen vertrauen FreshBooks, um professionelle Rechnungen zu erstellen. Vereinfachen Sie Ihre Buchhaltung. Buchhaltungssoftware Heute!

Wichtigste Vorteile

- Professionelle Rechnungserstellung

- Automatische Zahlungserinnerungen

- Zeiterfassung

- Projektmanagement-Tools

- Ausgabenverfolgung

Preisgestaltung

- Lite: 2,10 $/Monat.

- Plus: 3,80 $/Monat.

- Prämie: 6,50 $/Monat.

- Wählen: Individuelle Preisgestaltung.

Vorteile

Nachteile

Funktionsvergleich

Die Wahl der richtigen Buchhaltungssoftware kann für kleine Unternehmen geschäftsentscheidend sein. Geschäft Eigentümer.

Es geht darum, die Plattform zu finden, die wirklich den aktuellen Bedürfnissen Ihres Unternehmens entspricht.

Lassen Sie uns die wichtigsten Tools vergleichen, die Ihnen helfen, Zeit zu sparen und Ihr Geld zu verwalten.

1. KI-gestützte Automatisierung und Fehlerreduzierung

- Puzzle IO: Es handelt sich um eine KI-gestützte LösunguDas System wurde entwickelt, um mühsame Aufgaben wie die Transaktionskategorisierung zu bewältigen.1 Es führt kontinuierliche Genauigkeitsprüfungen durch, um potenzielle Fehler zu erkennen, bevor sie auftreten. Auswirkungen Ihre Bilanz. Automatisierung is a game-changer for startup founders and non-accountants.

- FreshBooks: FreshBooks bietet zudem intelligente Automatisierungsfunktionen für wiederkehrende Rechnungen und die Ausgabenverfolgung. Der Fokus liegt dabei auf der Vereinfachung von Arbeitsabläufen, insbesondere bei der Rechnungsstellung, wodurch Anwender Zeit bei manuellen Aufgaben sparen.

2. Finanzielle Einblicke und wichtige Kennzahlen

- Puzzle IO: Bietet Echtzeit-Einblicke in wichtige Kennzahlen, die für Startups in der Frühphase entscheidend sind, wie z. B. den Kapitalverbrauch und die Liquiditätsreichweite. Dies gibt Gründern ein genaueres Bild ihrer aktuellen Situation und hilft ihnen dabei, machen schnelle finanzielle Entscheidungen.

- FreshBooks: Bietet solide Buchhaltung Berichte wie Gewinn- und Verlustrechnung und Umsatzsteuerübersicht sind zwar nützlich, konzentrieren sich aber weniger auf die wichtigsten Kennzahlen des Startups, sondern vielmehr auf die allgemeine wirtschaftliche Lage aus der Perspektive der Standardbuchhaltung.

3. Umsatzrealisierung

- Puzzle IO: Speziell für Startups entwickelt, bietet es die automatisierte Umsatzrealisierung (Abgrenzung und Zahlungseingang) aus Quellen wie Stripe-Abonnements. Diese komplexe Funktion liefert klare Einblicke in die tatsächlichen Umsätze und spart so stundenlange Arbeit in Tabellenkalkulationen.

- FreshBooks: Obwohl in den höheren Stufen die doppelte Buchführung Anwendung findet, ist das System im Allgemeinen auf einfachere Anforderungen an die Einnahmen-Ausgaben-Rechnung oder die modifizierte periodengerechte Gewinnermittlung ausgerichtet. Es bietet nicht dieselbe automatisierte, abonnementorientierte Umsatzrealisierung wie Puzzle IO..

4. Projektrentabilitätsverfolgung

- Puzzle IO: Hervorragende Leistungen im Projektmanagement BuchhaltungWir bieten eine detaillierte Projektverfolgung, um die tatsächliche Rentabilität von Projekten im Vergleich zu Budgets und Ausgaben zu ermitteln. Dies ist ideal, wenn Sie Zeit und Material projektbezogen abrechnen.

- FreshBooks: Die Premium-Version und höhere Tarife bieten eine Funktion zur Verfolgung der Projektrentabilität. Diese Funktion ist zwar leistungsfähig, der Fokus liegt jedoch primär auf Kundenverwaltung und Rechnungsstellung und weniger auf tiefgreifenden finanziellen Projektanalysen.

5. Mobile Zugänglichkeit

- Puzzle IO: Bietet mobilen Zugriff auf aktuelle Finanzdaten, sodass Gründer und Mitgründer wichtige Kennzahlen auch unterwegs prüfen können..

- FreshBooks: Die mobile App von FreshBooks ist leistungsstark und weit verbreitet. iOS und Android-Geräten. Dadurch wird das Versenden von Rechnungen, die Zeiterfassung und die Ausgabenverwaltung von jedem mobilen Gerät mit Internetverbindung aus ganz einfach..

6. Verwaltung von Anlagevermögen und vorausbezahlten Ausgaben

- Puzzle IO: Beinhaltet eine integrierte Automatisierung für komplexe Posten wie Anlagevermögen und vorausbezahlte Ausgaben. Dies erleichtert es auch Nicht-Buchhaltern, die Einhaltung von Vorschriften sicherzustellen und sich ein genaues Bild zu verschaffen.

- FreshBooks: Konzentriert sich weniger auf diesen spezifischen, komplexen Bereich der Buchhaltung, der normalerweise von Ihrem Buchhalter oder durch einen Sachbearbeiter abgewickelt wird.ualle Tagebucheinträge.

7. Bankabstimmung und Transaktionen

- Puzzle IO: Verfügt über automatisierte Bankabstimmung und ausgefeilte Transaktionskategorisierung, um sicherzustellen, dass Ihre Bankkonten immer auf dem neuesten Stand sind und Ihnen so mühsame Aufgaben erspart bleiben.

- FreshBooks: Ab dem Plus-Tarif ist ein Bankabgleich möglich, der sicherstellt, dass Ihre Buchhaltungsdaten mit Ihren Bankkonten übereinstimmen. Außerdem bietet das Programm eine automatische Ausgabenkategorisierung.

8. Unterstützung für die Kreditorenbuchhaltung

- Puzzle IO: Unterstützt die wichtigsten Funktionen der Kreditorenbuchhaltung, um Rechnungen zu verfolgen und zu bezahlen, und bietet so einen vollständigen Überblick über die Geldausgänge, was für die Prognose der Liquiditätsreichweite von entscheidender Bedeutung ist.

- FreshBooks: Beinhaltet die Nachverfolgung der Kreditorenbuchhaltung ab dem Premium-Tarif, wodurch Folgendes möglich ist Kleinunternehmen Eigentümer müssen Rechnungen und Lieferanten verwalten.

9. Berichterstattung an Investoren und über Kapitalbeschaffung

- Puzzle IO: Ist ideal für Gründer und Investoren von Startups, da es sofortige Berichte über Kennzahlen wie Burn Rate und Cash Runway generiert, sodass Sie nie warten müssen, um über die Zukunft zu sprechen.

- FreshBooks: Es bietet zwar gute Finanzberichte, konzentriert sich aber weniger auf die spezifischen Berichterstattung und wichtige Kennzahlen, die von Investoren in der Frühphase eines Unternehmens häufig angefordert werden.

10. Preispläne und Skalierbarkeit

- Puzzle IO: Die Preispläne sind oft auf Startups ausgerichtet, die spezialisierte Buchhaltungslösungen suchen, welche zwar teurer sein können, aber von Anfang an fortschrittliche Funktionen bieten..

- FreshBooks: Bietet verschiedene Preispläne wie den Lite-Plan und den Plus-Plan an, wodurch es sowohl für Freiberufler als auch für wachsende Unternehmen skalierbar ist. Für Funktionen wie die Verfolgung der Projektrentabilität benötigen Sie jedoch den Premium-Plan.

Worauf Sie bei der Auswahl von Buchhaltungssoftware achten sollten?

- Lesen Sie FreshBooks-Bewertungen, um zu erfahren, was Kleinunternehmer tatsächlich über die FreshBooks-Plattform denken.

- Schauen Sie sich die verschiedenen Preispläne (Lite, Plus, Premium und Select) an und sehen Sie, wie viele abrechnungsfähige Kunden Sie pro Monat erhalten.

- Prüfen Sie die Rechnungsstellungsfunktionen, wie z. B. die Möglichkeit zur Erstellung individueller Rechnungen, die Option zum Versenden wiederkehrender Rechnungen und die einfache Umwandlung von Kostenvoranschlägen in Rechnungen.

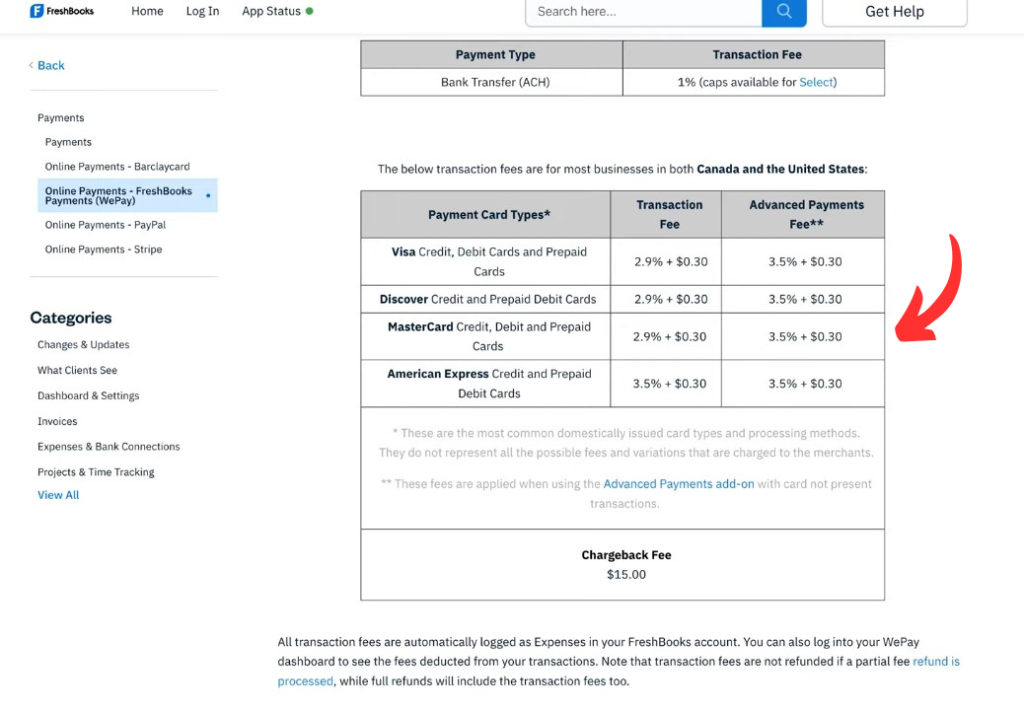

- Stellen Sie sicher, dass die Plattform es Ihnen ermöglicht, Zahlungen einfach zu akzeptieren, einschließlich Online-Zahlungen, Vorauszahlungen und verschiedener Arten von FreshBooks-Zahlungen wie Kreditkarten, ACH-Zahlungen oder Banküberweisungen.

- Wenn Sie persönlich verkaufen, prüfen Sie, ob die Software ein virtuelles Terminal oder die Integration mit Kassensystemen unterstützt.

- Sehen Sie selbst, wie gut Sie Projekte verwalten und abrechnungsfähige Zeiten mit den integrierten Funktionen erfassen können. Zeiterfassung.

- Prüfen Sie das Freshbooks-Dashboard, um festzustellen, ob es Ihnen die benötigten Echtzeit-Einblicke auf einen Blick liefert.

- Prüfen Sie, ob bei überfälligen Zahlungen automatisch Mahngebühren erhoben werden.

- Machen Sie sich mit den Einschränkungen für Teammitglieder oder zusätzliche Benutzerkonten in dem von Ihnen gewählten Tarif vertraut.

- Schauen Sie sich die Häufig gestellte Fragen zu FreshBooks für konkrete Fragen, bevor Sie Ihre Entscheidung endgültig treffen.

- Erkundigen Sie sich nach dem Kundendienst und den enthaltenen Leistungen, insbesondere bei den günstigeren Tarifen.

- Überlegen Sie, ob die Begrenzung der abrechnungsfähigen Kunden im Lite-Tarif ausreicht oder ob Sie bald den Plus-Tarif oder einen höheren Tarif für eine unbegrenzte Anzahl von Kunden benötigen.

- Der Select-Tarif bietet oft exklusiven Zugriff und eignet sich möglicherweise am besten für Unternehmen mit mehreren Geschäftspartnern.

- Prüfen Sie die Integrationsmöglichkeiten mit anderer Buchhaltungssoftware, wie zum Beispiel QuickBooks Online oder andere Tools, die Sie derzeit verwenden.

- Achten Sie auf Funktionen wie Kundenreservierungen und die Möglichkeit, nicht abgeglichene Transaktionen zu verarbeiten und zu exportieren. Daten über eine CSV-Datei.

- Eine kostenlose Version oder Testversion kann Ihnen helfen, die Kernfunktionen zu testen, bevor Sie sich für die monatliche Pauschalgebühr entscheiden.

- Stellen Sie sicher, dass die Plattform die Vorbereitung auf die Steuererklärung durch die Bereitstellung der notwendigen Berichte unterstützt.

- Empfehlen Sie FreshBooks erst dann weiter, wenn Sie sich vergewissert haben, dass es Ihren Bedürfnissen als Selbstständiger entspricht.

Endgültiges Urteil

Nach eingehender Betrachtung beider Aspekte sind unsere abschließenden Gedanken klar.

Wenn Sie eine Einzelperson oder ein kleines Dienstleistungsunternehmen sind, ist FreshBooks Buchhaltungssoftware ist der Gewinner.

Es zeichnet sich durch ein intuitives Design aus und ermöglicht die einfache Erstellung professioneller Rechnungen und unbegrenzter Kostenvoranschläge.

Es wurde entwickelt, um Sie bei der Finanzverwaltung zu unterstützen und die Einhaltung der Steuervorschriften zu vereinfachen.

FreshBooks bietet vier Tarife an, und selbst die drei günstigeren Tarife eignen sich hervorragend, um Ihre Finanzen mit weniger Zeitaufwand in Ordnung zu bringen. Buchhaltung.

Während Puzzle IO stark darin ist, Projekte zu verfolgen und detaillierte Finanzanalysen für Startups durchzuführen.

FreshBooks eignet sich im Allgemeinen besser für Kleinunternehmer, die keine Finanzexperten sind.

Es ist einfacher zu bedienen als die meisten anderen Softwareprogramme und lässt sich unkompliziert einrichten.

Wir haben uns für Puzzle entschieden, um einen tieferen Einblick in die Finanzen von Startups zu erhalten, aber FreshBooks ist die zuverlässige Wahl für die meisten Unternehmen, die ein solides Projektmanagement- und Rechnungsstellungstool benötigen.

Mehr von Puzzle IO

Wir haben Puzzle IO mit anderen Buchhaltungstools verglichen. Hier ein kurzer Überblick über die herausragenden Funktionen:

- Puzzle IO vs Xero: Xero bietet umfassende Buchhaltungsfunktionen mit starken Integrationen.

- Puzzle IO vs Dext: Puzzle IO zeichnet sich durch KI-gestützte Finanzanalysen und Prognosen aus..

- Puzzle IO vs Synder: Synder zeichnet sich durch die Synchronisierung von Verkaufs- und Zahlungsdaten aus.

- Puzzle IO vs. Einfaches Monatsende: Easy Month End vereinfacht den Finanzabschluss.

- Puzzle IO vs Docyt: Docyt nutzt KI zur Automatisierung von Buchhaltungsaufgaben.

- Puzzle IO vs RefreshMe: RefreshMe konzentriert sich auf die Echtzeitüberwachung der finanziellen Leistungsfähigkeit.

- Puzzle IO vs Sage: Sage bietet robuste Buchhaltungslösungen für Unternehmen unterschiedlicher Größe.

- Puzzle IO vs Zoho Books: Zoho Books bietet erschwingliche Buchhaltung mit CRM Integration.

- Puzzle IO vs Wave: Wave bietet kostenlose Buchhaltungssoftware für Kleinunternehmen an.

- Puzzle IO vs Quicken: Quicken ist bekannt für Finanzmanagement für Privatpersonen und kleine Unternehmen.

- Puzzle IO vs Hubdoc: Hubdoc ist auf das Sammeln von Dokumenten und das Extrahieren von Daten spezialisiert..

- Puzzle IO vs Expensify: Expensify bietet umfassende Spesenabrechnung und -verwaltung.

- Puzzle IO vs QuickBooks: QuickBooks ist eine beliebte Wahl für die Buchhaltung kleiner Unternehmen.

- Puzzle IO vs AutoEntry: AutoEntry automatisiert die Dateneingabe von Rechnungen und Belegen.

- Puzzle IO vs FreshBooks: FreshBooks ist speziell auf die Rechnungsstellung von Dienstleistungsunternehmen zugeschnitten.

- Puzzle IO vs NetSuite: NetSuite bietet eine umfassende Suite für Enterprise Resource Planning (ERP).

Mehr von FreshBooks

- FreshBooks vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- FreshBooks vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- FreshBooks vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- FreshBooks vs. SnyderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- FreshBooks vs. Easy MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- FreshBooks vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- FreshBooks vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- FreshBooks vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- FreshBooks vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- FreshBooks vs QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- FreshBooks vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- FreshBooks vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- FreshBooks vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- FreshBooks vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- FreshBooks vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Welche Buchhaltungssoftware eignet sich am besten für Kleinunternehmen?

Die „beste“ Lösung hängt von Ihren Bedürfnissen ab, aber cloudbasierte Optionen wie FreshBooks sind aufgrund ihrer Benutzerfreundlichkeit und der auf kleinere Betriebe zugeschnittenen Funktionen beliebt.

Kann ich mit diesen Online-Buchhaltungssoftware-Optionen eine Bilanz einsehen?

Ja, sowohl Puzzle IO als auch FreshBooks bieten die Möglichkeit, eine Bilanz zu erstellen, wobei die Funktionen je nach Tarif variieren können.

Ist cloudbasierte Buchhaltungssoftware sicher für meine Finanzdaten?

Seriöse Anbieter cloudbasierter Buchhaltungssoftware investieren stark in Sicherheitsmaßnahmen zum Schutz Ihrer Finanzdaten. Überprüfen Sie deren Sicherheitsprotokolle.

Lassen sich diese Online-Buchhaltungssoftware-Optionen mit anderen Geschäftsanwendungen integrieren?

Ja, sowohl Puzzle IO als auch FreshBooks bieten Integrationen mit verschiedenen Geschäftsanwendungen an; der Umfang der Integration ist jedoch unterschiedlich.

Welche Buchhaltungssoftware für Kleinunternehmen ist am einfachsten zu erlernen?

FreshBooks wird oft für seine benutzerfreundliche Oberfläche gelobt und ist daher eine gute Wahl für alle, die neu im Bereich Online-Buchhaltungssoftware sind.