Tired of messy finances and endless spreadsheets?

Many of us feel overwhelmed by managing money, especially small businesses and solopreneurs.

It’s a real headache.

What if you could automate all your financial tracking?

Imagine getting a clear view of your money without the hassle.

Fintable promises to do just that. We’ll explore how Fintable can solve your financial problems and simplify your life.

Is it the tool for you? Let’s find out!

Ready to save 10+ hours a month on financial tasks? Join 5,000+ users simplifying their money with Fintable today!

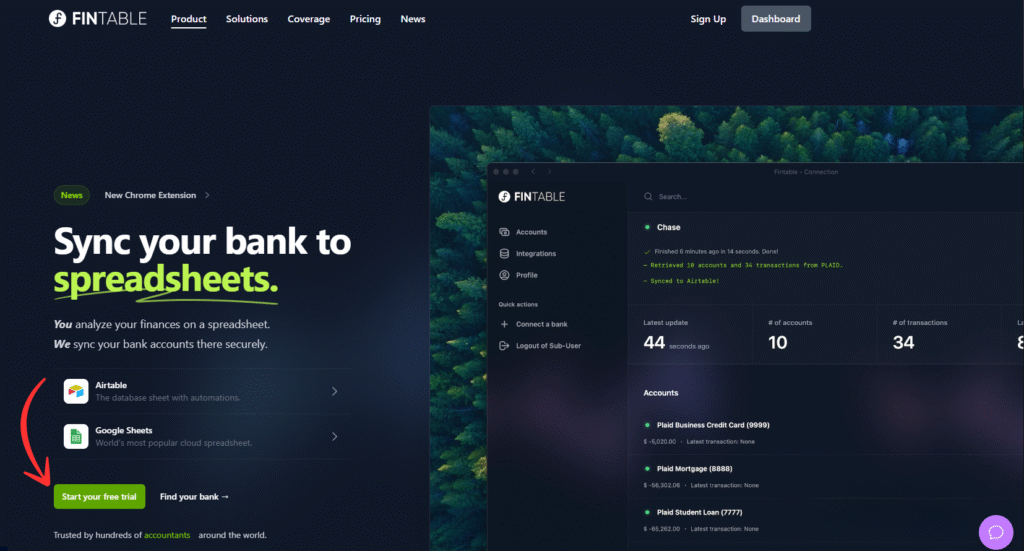

What is Fintable?

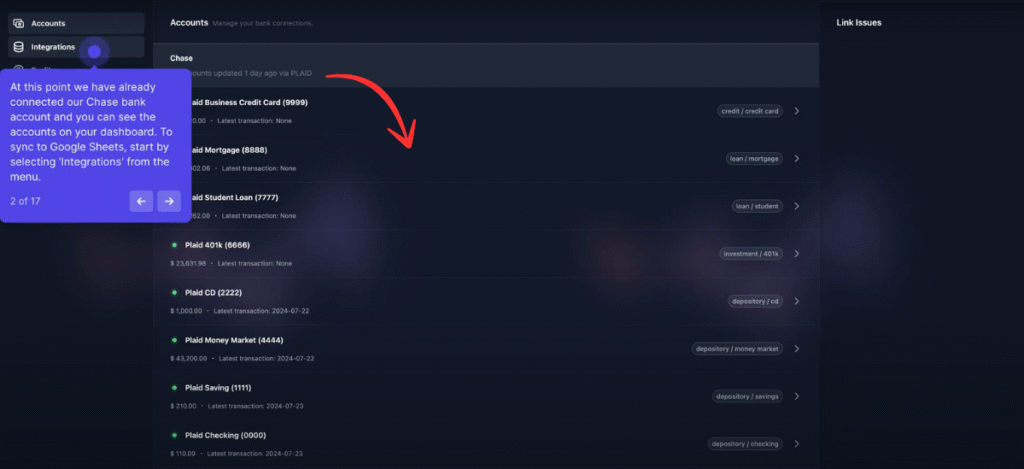

Fintable is an app that helps you manage your money easily.

Think of it as a bridge between your bank accounts and your favorite spreadsheets.

It links directly to your bank accounts &brings all your financial data into one place.

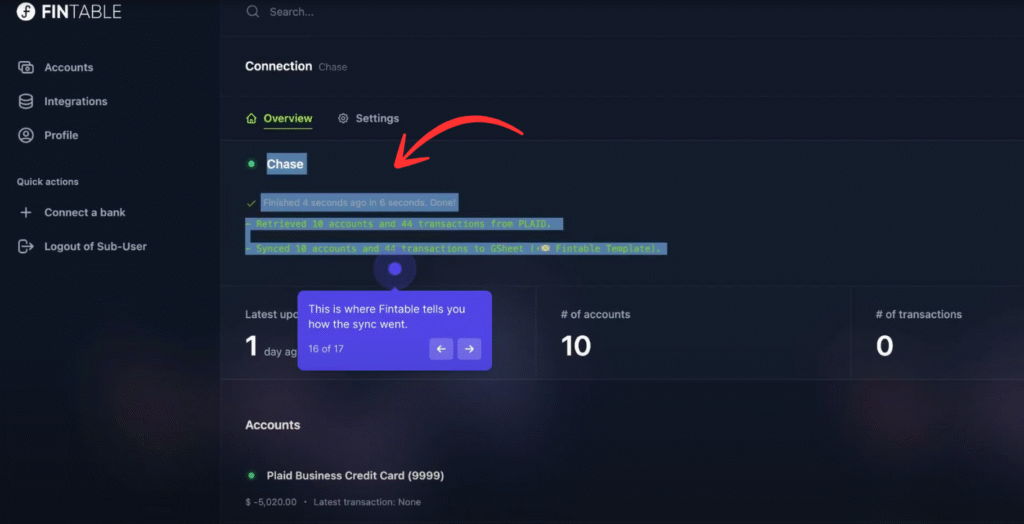

Specifically, Fintable sends your bank balances and transactions to either Google Sheets or Airtable.

This means you get a clear view of every transaction that happens in your accounts.

You can see your latest bank balances updated regularly.

Fintable makes your money workflow much simpler.

So you don’t have to enter data or spend hours organizing your financial information manually.

Who Created Fintable?

Fintable was created by Isa Hasenko.

He had the idea for Fintable in 2020 while trying to manage his own money.

He was in Kyiv and thought, “What if I could just do all this in Airtable?”

His goal was to make it super easy for anyone to get their financial data into spreadsheets without needing special skills.

Fintable aims to be the quickest way to use bank data for personal or business finances, helping people save time and stress.

Top Benefits of Fintable

Here are some of the main benefits you get from using Fintable:

- Easy Data Connection: Fintable uses Plaid to create a strong connection with your bank accounts. This makes it safe and simple to get your financial data.

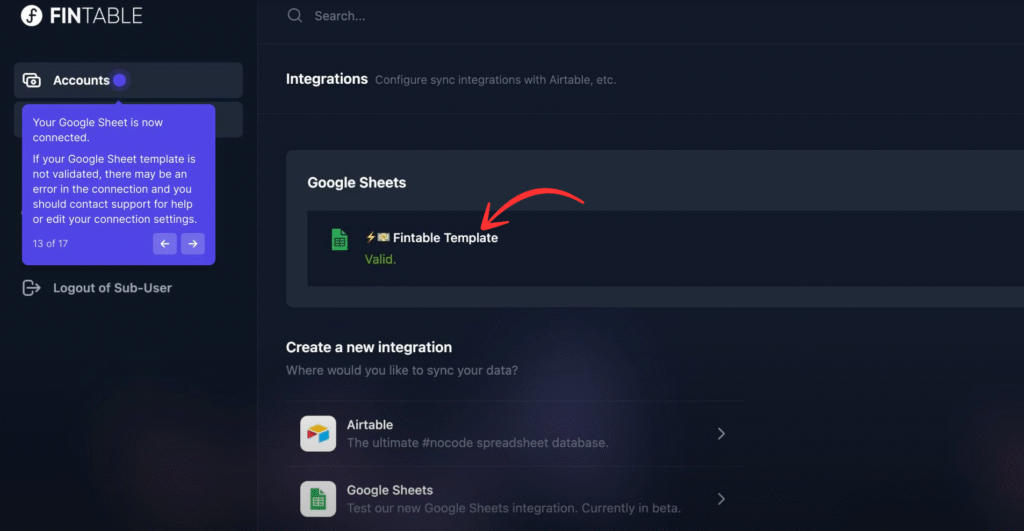

- Seamless Integration: It offers smooth integration with your favorite spreadsheet tools like Google Sheets and Airtable. You can easily integrate your financial data workflows without any complex setup.

- Better Budgeting: With all your transactions in one place, it’s much easier to budget. You can clearly see where your money is going and make smarter spending choices for your finances.

- Time-Saving Automation: Fintable automates the process of pulling data from your bank. This saves you a lot of time that you used to spend manually updating spreadsheets.

- Customizable for Your Needs: Whether you’re a regular customer or a developer, you can set up Fintable to fit exactly how you want to track your money. It’s flexible for many different uses.

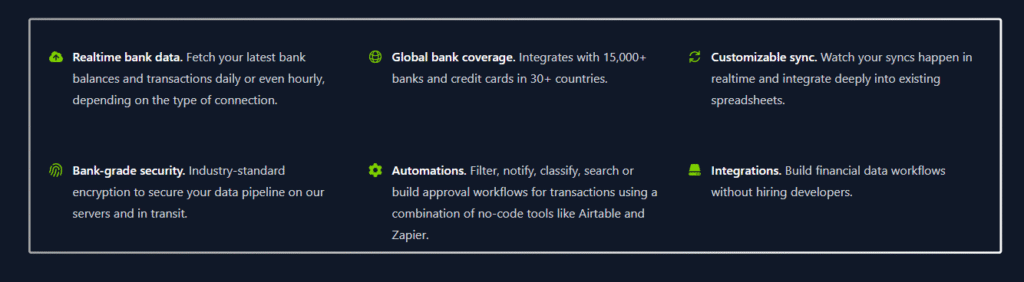

Best Features of Fintable

Fintable offers some powerful features that make managing your financial data a breeze.

These unique tools help you stay on top of your money with less effort and more peace of mind.

1. Realtime Bank Data

Fintable can pull your latest bank balances and transactions very quickly.

This means you always have up-to-date information right in your spreadsheet.

No more waiting days to see your most recent spending or income.

2. Secure Pipeline

Your financial information is sensitive, and Fintable treats it that way.

It uses a very secure process, or “pipeline,” to move your data from your bank to your spreadsheet.

This helps keep your information safe during transit.

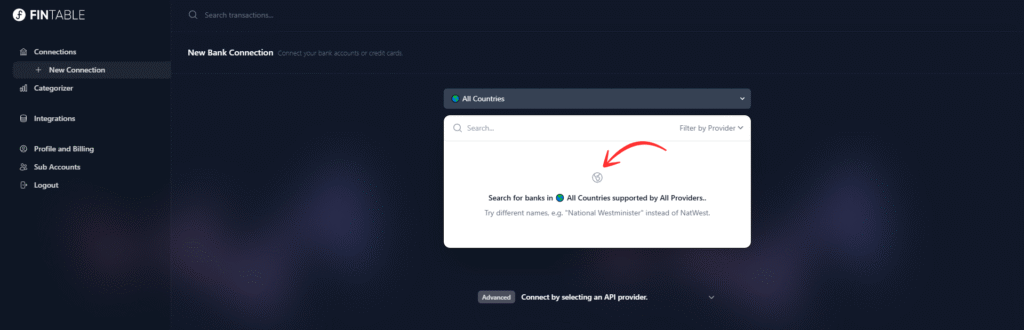

3. Global Bank Coverage

Whether you’re in the US, Europe, or many other places, Fintable likely works with your bank.

It connects with thousands of banks and credit cards in over 30 countries.

This wide reach makes it a useful tool for many users around the world.

4. Bank-Grade Security

Fintable uses top-level security measures, just like banks do.

This includes strong encryption and following strict industry rules to protect your data.

You can feel confident that your financial details are well-protected.

5. Automations

One of the coolest things about Fintable is how it helps you automate tasks.

You can set up rules to filter, categorize, or even get alerts about your transactions.

This saves you a lot of time and makes managing your money much more efficient.

Pricing

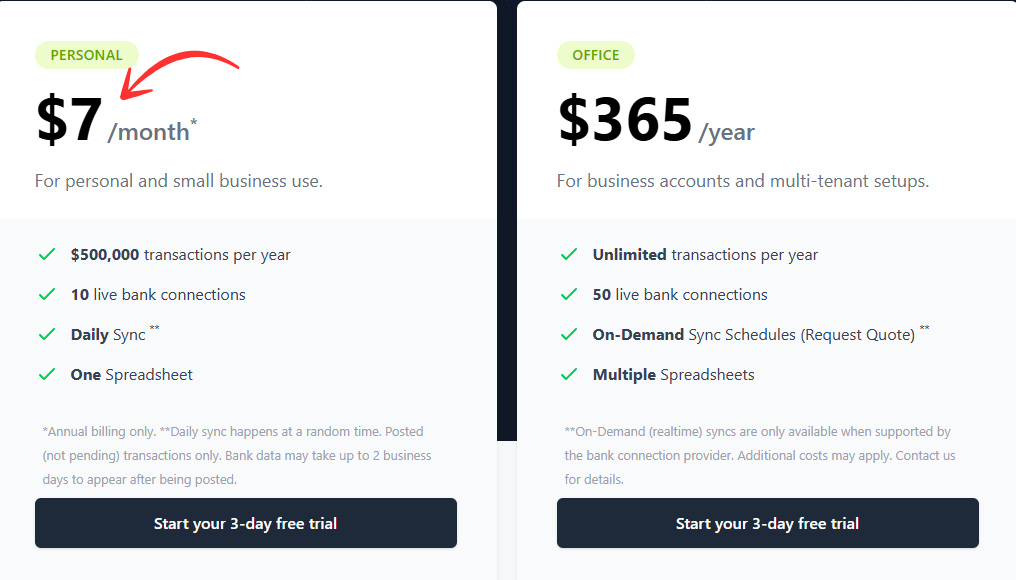

Fintable offers different plans so you can pick what works best for you.

Here’s a quick look at their main pricing options:

| Plan | Cost | Key Features |

| Personal | $7 / month (billed yearly) | Up to $500,000 in transactions yearly, 10 bank connections, daily sync, one spreadsheet. |

| Office | $365 / year | Unlimited transactions, 50 bank connections, on-demand sync (may cost extra), multiple spreadsheets. |

Pros and Cons

Before making any decision, it’s smart to weigh the good with the bad.

Let’s look at the main pros and cons of Fintable to help you decide.

Pros

Cons

Alternatives to Fintable

While Fintable is a great tool, it’s helpful to know what other options are out there. Different tools suit different needs, so you might find one of these works better for you.

- Tiller Money: This service also connects your bank accounts to Google Sheets or Excel. It focuses on giving you full control over your data in your spreadsheets, ideal for spreadsheet lovers.

- Mint: A popular free personal finance app. Mint offers budgeting, bill tracking, and credit score monitoring, connecting directly to many financial institutions.

- LiveFlow: LiveFlow helps businesses get realtime financial reports directly in Excel or Google Sheets. It connects to accounting systems like QuickBooks and Xero.

- Simplifi by Quicken: This tool offers a simple dashboard for an overview of your finances. It’s a good choice for balancing features with ease of use.

- PocketGuard: This app helps prevent overspending by showing you how much money you have left after bills. It’s intuitive for those who struggle with impulse spending.

- QuickBooks Online: A comprehensive accounting software for small businesses. It handles invoicing, expense tracking, and payroll.

- Xero: Another strong accounting software for small businesses. Xero is known for multi-currency support and strong reporting.

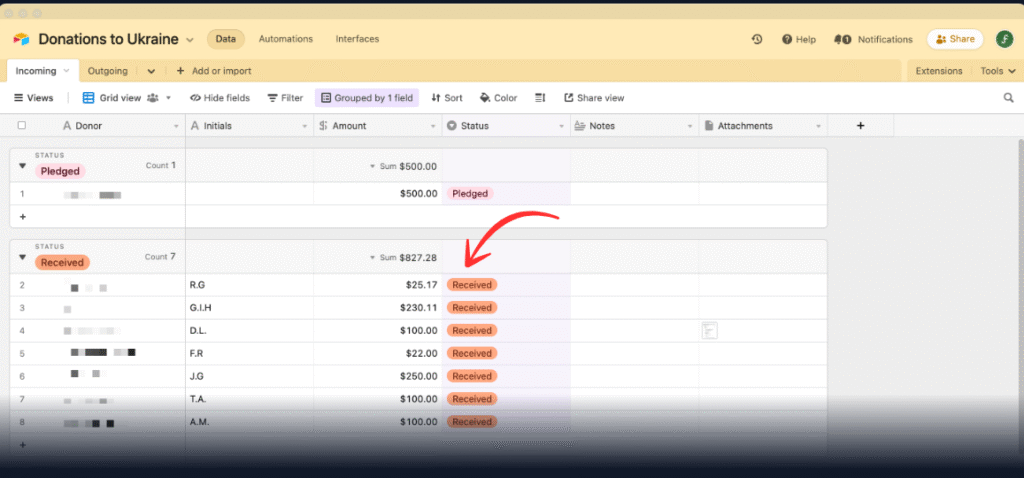

Personal Experience with Fintable

Our team recently tested Fintable for managing Link Finder’s operational finances.

We needed a better way to track expenses and revenue without manual data entry.

Fintable promised to simplify things, and it really delivered.

Here’s how Fintable helped us:

- Realtime Bank Data: We got instant updates from our bank accounts. This meant we always knew our current balances.

- Secure Pipeline: Our financial data felt safe moving to Google Sheets. We didn’t worry about security risks.

- Seamless Integration: Fintable connected easily with our existing Google Sheets. It fit right into our workflow.

- Automations: We set up rules to tag transactions automatically. This saved us hours of sorting work each week.

- Better Budgeting: With all data in one place, budgeting became much clearer. We could see exactly where Link Finder’s money was going.

Final Thoughts

Fintable offers a powerful way to connect your bank data directly to spreadsheets like Google Sheets or Airtable.

It simplifies financial tracking by providing realtime updates.

Strong security and global bank coverage.

While it might have a learning curve for those new to spreadsheets, or comes with costs for advanced features.

Its ability to automate data entry & streamline your financial workflow is a major plus.

If you’re tired of manual bookkeeping & want a flexible tool to manage your money efficiently.

Fintable is definitely worth considering. Ready to simplify your finances?

Visit fintable.io today and see how it can transform your financial management.

Frequently Asked Questions

Does Fintable work with my bank?

Yes, Fintable connects to thousands of banks and credit cards. It has global coverage in over 30 countries. You can usually check their website for specific bank support.

Is my financial data safe with Fintable?

Absolutely. Fintable uses bank-grade security measures. This includes strong encryption and partnerships with trusted data brokers like Plaid to protect your information.

Can Fintable categorize my transactions automatically?

Yes, Fintable offers automation features. You can also set up rules to automatically categorize your transactions. This saves time and helps with budgeting.

Do I need to know how to code to use Fintable?

No, you do not need to code. Fintable is designed to be user-friendly. It integrates with no-code tools like Google Sheets and Airtable for easy setup.

What kind of financial data does Fintable pull?

Fintable primarily syncs your bank balances and transactions. For some banks, it may also pull pending transactions or investment holdings.